On 22 August, the US Department of Commerce (DOC) delayed its preliminary decision into its investigation into alleged circumvention of antidumping and countervailing duties (AD/CVD) by solar manufacturers in Southeast Asia, extending the timelines of what has become one of the most closely watched and impactful legal battles in the US solar sector’s history.

The extension until 28 November will also push back the final decision from its initial date of 27 January. The department said it needed “additional time” to analyse “voluminous administrative record, including multiple questionnaire and supplemental questionnaire responses”.

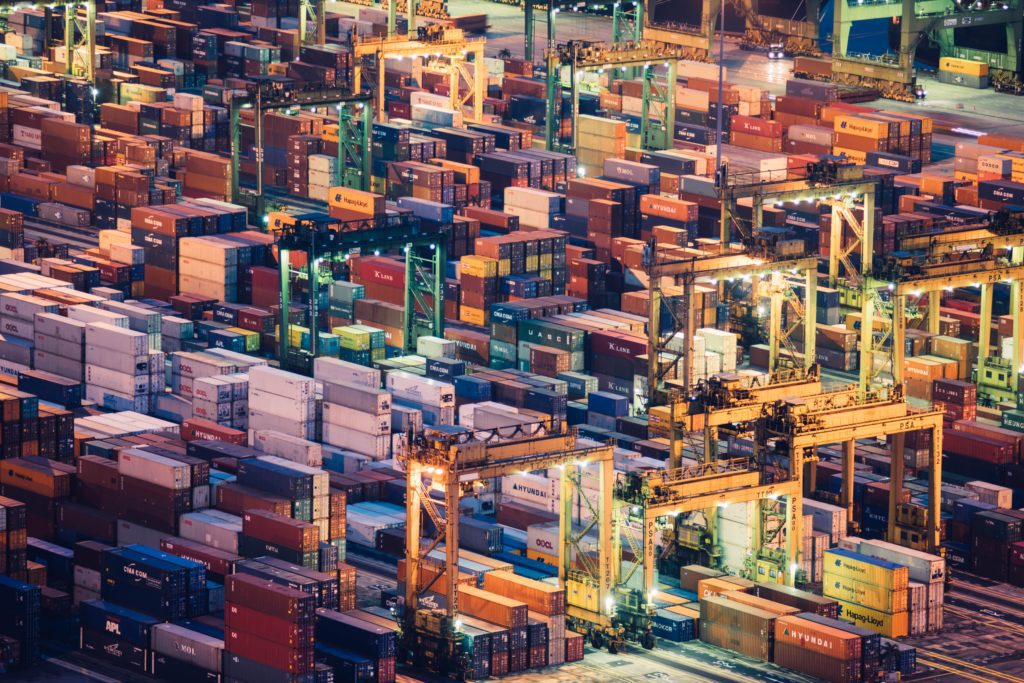

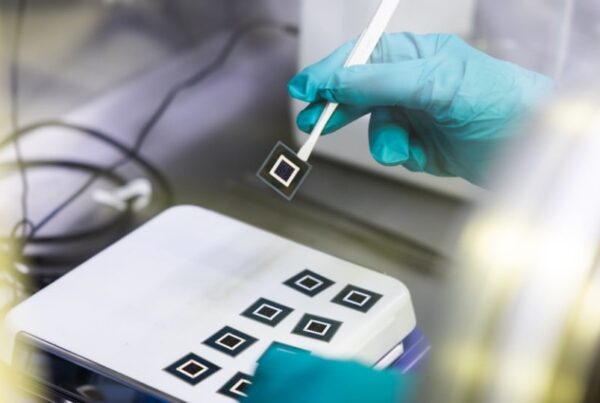

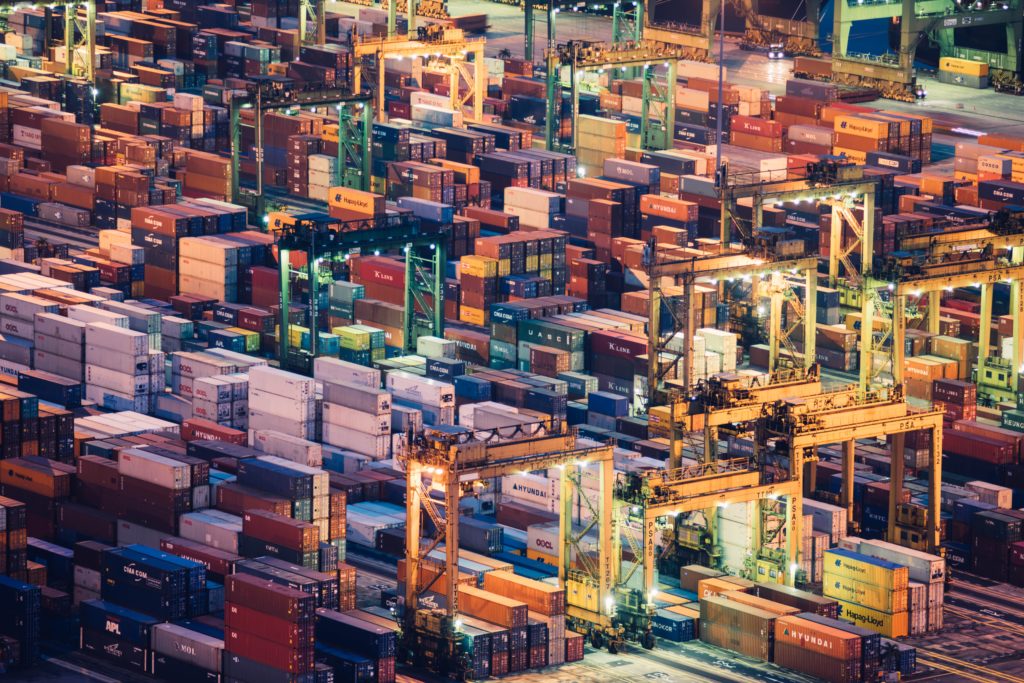

To recap briefly, in March the DOC launched an investigation into AD/CVD by solar manufacturers in Cambodia, Malaysia, Thailand and Vietnam following a petition by small US module producer Auxin Solar that essentially froze module imports to the US from those countries, which have acted as export outposts for key Chinese PV manufacturers in recent years.

This resulted in chaos in the US solar sector. A Solar Energy Industries Association (SEIA) survey in the month following revealed that 83% of module purchasers had shipments either delayed or cancelled and 70% of respondents said at least half of their solar workforce was at risk due to the damaging impact of the case. Meanwhile, solar installs in the US were forecast to drop by almost half.

Then, in early June, US President Joe Biden signed an executive order to waive tariffs on solar imports from Southeast Asia for two years as part of a swathe of measures to boost renewables deployment in the US’ faltering clean energy sector.

The White House branded the measure as a “bridge” for solar imports while “reinforcing the integrity of our trade laws and processes”.

But the legality of the order has been hotly contested. PV Tech Premium has previously reported how questions have been raised about the legality of the move as industry stakeholders assess the risk of it being challenged in court.

Kyle Hayes, special counsel for international law firm Baker Botts, told this site that the main question on stakeholders’ minds was whether the DOC would be able to issue tariffs while Biden’s waiver was still in place, regardless of whether it decides to do so or not.

“As a practical matter, I believe that most folks think that as long as the Biden waiver is in effect over the next two years, the Commerce tariffs that come out of either the preliminary or final ruling would not be able to be effectuated until the waiver is no longer in place,” said Hayes.

“This is effectively a constitutional question because the DOC is an executive agency which would then be in conflict with a presidential order,” he continued, adding that “the DOC is probably not looking to have a showdown with President Biden over the tariff waiver.”

But if those DOC tariffs are imposed, there is still uncertainty as to whether they will be retroactive or not. Elliott Williams, an attorney at clean energy lawyers Stoel Rives, told PV Tech Premium: “The risk of retrospective tariffs is ameliorated by the President’s 6 June order asking Commerce to consider a 24-month moratorium on duties for the goods at issue in this investigation.

“However, the risk is not zero since we are still waiting to see what rule Commerce will implement based on the President’s order and on the comments that Commerce received on its proposed rule for a 24-month moratorium. And such rule, when it comes out, may be subject to potential legal challenge.”

On top of this, there is uncertainty as to when the tariffs would be applied and at what rate. “So the legal question is still pretty much up in the air,” noted Hayes.

Legal matters aside, uncertainty around the case is being felt across the US solar sector. Pol Lezcano, solar analyst at BloombergNEF , previously told this site that developers were looking to stock up on modules over the next couple of years for plants under construction now but also for early-stage projects in their pipelines.

Indeed, Hayes has clients who are working hard to “secure capacity and pricing for 2025 to 2027, understanding that the Biden tariff waiver will expire in June 2024,” he said, “so they’re trying to get ahead of that if the worst-case scenario manifests itself.”

“The upshot is that the industry will not come to a standstill as long as everyone has faith in the Biden waiver. The real question is ‘what happens beyond 2024?’” Hayes asked.

“As a result, you’re seeing developers focus on that June 2024 date and do anything they can to hedge and lock-in pricing, even if it’s at a bit of a premium.”

AD/CVD: A timeline

August 2021: A group of anonymous solar manufacturers, dubbed the American Solar Manufacturers Against Chinese Circumvention (A-SMACC), petitions the US Department of Commerce to investigate alleged circumvention of AD/CVD tariffs by manufacturers based across Southeast Asia.

September 2021: The Department of Commerce delays its verdict on the A-SMACC petition, requesting new information to proceed, including the identities of those companies included within the group.

November 2021: The Department of Commerce rejects the A-SMACC petition, citing the ongoing anonymity of those included within the group as an obstacle to further proceedings.

February 2022: Auxin Solar, a hitherto little-known US module manufacturer, launches a new petition with the US Department of Commerce to investigate potential circumvention of AD/CVD tariffs by Southeast Asia-based manufacturers.

March 2022: The Department of Commerce confirms it will investigate alleged AD/CVD circumvention following Auxin Solar’s petition, effectively halting US module supply from Southeast Asia.

May 2022: Eight major module manufacturers with operations in Southeast Asia are selected as mandatory respondents to Commerce’s investigation.

June 2022: With the investigation still ongoing, the Biden administration confirms it will waive certain trade tariffs on solar products for two years, effectively meaning AD/ CVD tariffs will not be implemented until June 2024 at the earliest.

November 2022: The preliminary findings of the Department of Commerce’s investigation are announced. This has been extended from August 2022.

January – April 2023: A final decision on the investigation, including any prospective tariff rates, are to be announced by the Department of Commerce, although this is now likely to also be pushed back following the preliminary decision delay.