This new subsidy aims to reduce the Netherlands’ dependence on other countries to procure these components.

A consultation has been opened until 3 March 2024 and can be accessed here (in Dutch). The consultation aims to collect information regarding the conditions of the subsidy, its duration and the amount of the subsidy, among others.

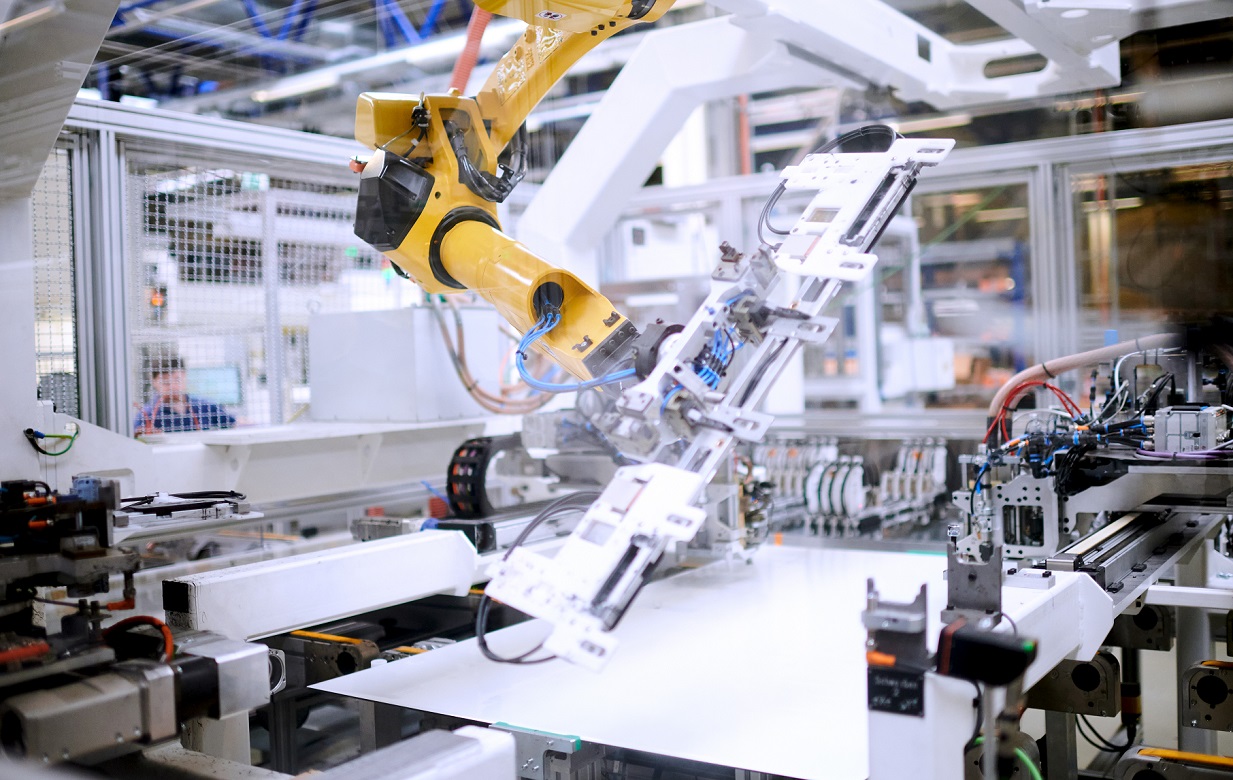

Addressing Europe’s manufacturing challenges

This upcoming subsidy from the Netherlands comes at a time when the European solar manufacturing industry has been in a critical state, with many in the sector calling for emergency measures to protect European industry.

The European Commission, despite acknowledging the current situation of the solar manufacturing industry, came short of implementing any new legislation to aid the situation. This week two blog posts, published on PV Tech, have looked at Europe’s current manufacturing challenges and how the industry can meet them by playing to its key strengths.

Davor Sutija, CEO at NexWafe, looked at how Europe needs to embrace innovation, foster supportive policies and build alliances between European solar companies. Head of research at PV Tech, Finlay Colville, wrote about opportunities for PV production and equipment and material suppliers in Europe to meet the increased demand in the US and India as both countries are ramping up their own domestic solar manufacturing industry.

The Netherlands is the latest European country looking to reshore domestic manufacturing capacity, following Germany, which launched an expression of interest last year seeking 10GW of solar manufacturing capacity, and Hungary, which implemented a €2.4 billion (US$2.6 billion) scheme for renewables manufacturing.

As European countries implement subsidies or schemes towards renewables manufacturing, last week the European Union adopted the Net Zero Industry Act (NZIA), which is expected to give a boost to the domestic renewables manufacturing industry.

Under the rules implemented by the NZIA, the EU will now regulate the purchase of PV modules in order to avoid any member state acquiring more than half of the modules in auctions from a single country.

Furthermore, the construction or expansion of manufacturing plants will see a faster permit-granting process, with plants with less than 1GW of capacity guaranteed a wait of no more than 12 months, while larger plants will wait no longer than 18 months, and shorter deadlines to be set for strategic projects.