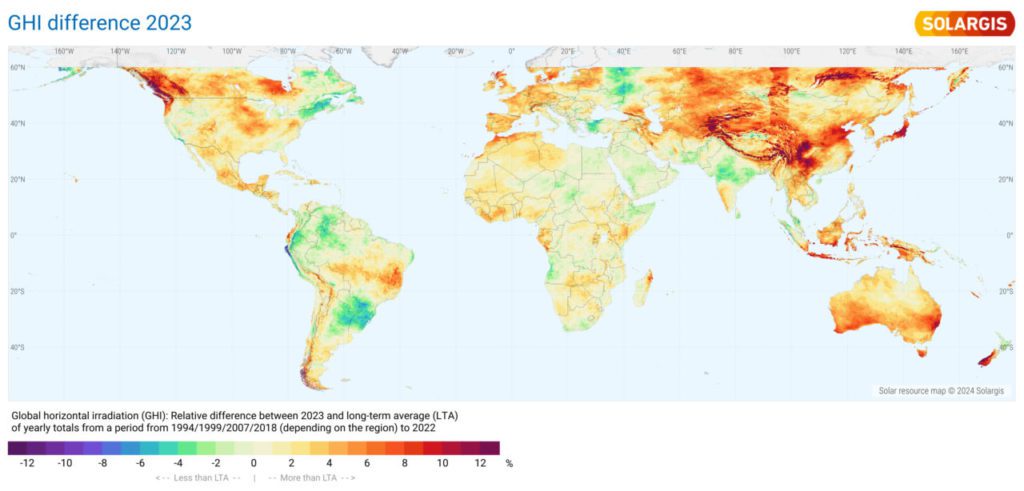

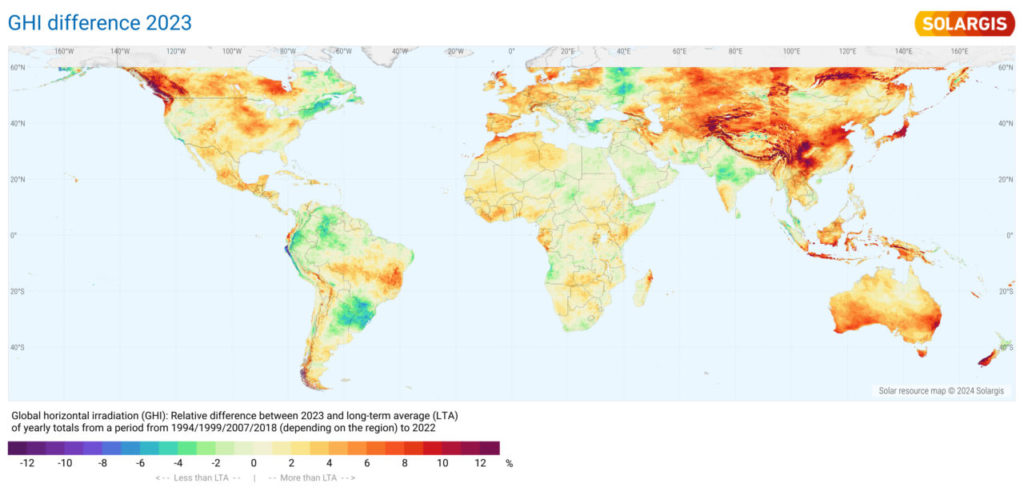

Some regions enjoyed a higher level of solar irradiance including Southeast Asia and Australia. Thanks to favourable weather conditions and reduced cloud cover, Southeast Asia and Australia exceeded their long-term solar irradiance averages by 10% and 2% respectively.

Europe also had higher than average solar irradiance, particularly in southern Nordic regions, with most of the regions on the continent exceeding their long-term average by between 1% and 7%. Solargis said it was due to reduced cloudiness and rainfall.

In India, the majority of the country continued to suffer from a long-term dip in solar irradiance mainly due to the prolonged monsoon season, which resulted in reduced solar resource availability. Although Central India’s solar irradiance was lower than its long-term average by between 1% and 5%, Southern India’s solar irradiance was up to 5% above the long-term average because of extremely dry and sunny June and August.

Mixed solar irradiance was recorded in the Americas. In the US, some regions benefited from the El Niño effect that brought more sunshine and less precipitation, while Central America boasted stronger than average solar irradiance.

In South America, La Niña affected some parts of the continent including Southern Brazil, reducing the solar resource availability.

“Across 2023, solar power stood as a shining beacon of hope amidst an unprecedented climate crisis and soaring global temperatures. Our analysis shows that solar irradiance was stable or even higher than usual in many regions, supporting the growth and competitiveness of industry against other energy sources,” said Marcel Suri, CEO and founder of Solargis.

Although higher solar irradiance was witnessed in many parts of the world, extreme weather conditions could damage solar projects at the regional level. For example, more frequent and severe hailstorms in the US and Australia inflicted losses on solar projects and affected the insurability of projects.

According to a report from renewable energy project underwriter GCube Insurance, hail claims averaged nearly US$58.4 million per claim.

To better prepared for extreme weather events, Solargis suggested that stakeholders in the solar industry should address stable power grids, solar financing in developing economies and supply chain capacity in 2024 and beyond.

PV Tech recently published an article that examines the reasons for solar insurers tightening business interruption and equipment breakdown terms.

Suri said: “There is an increased need for stakeholders to closely monitor and analyse solar resource trends. As we navigate through the extremes, stakeholders must enhance their monitoring, analysing, and optimising capabilities to mitigate risks and embrace the unstoppable ascent of solar power in our global energy landscape.”