Solar PV and wind generation will be at the heart of Australia’s green hydrogen production goals, with these two technologies being the cheapest forms of renewable energy generation.

Although Australia’s wind sector has started to pick up pace, solar PV continues to be the dominant clean energy technology, with it being added at an increasingly rapid pace. Indeed, 1.2GW of large-scale solar PV was added to the National Electricity Market (NEM) in the past 12 months, compared to wind’s 0.2GW.

With the rapid rollout of solar PV, the price of the electricity generated will ultimately come down, allowing green hydrogen to be produced at lower rates, something that has plagued the industry in recent years.

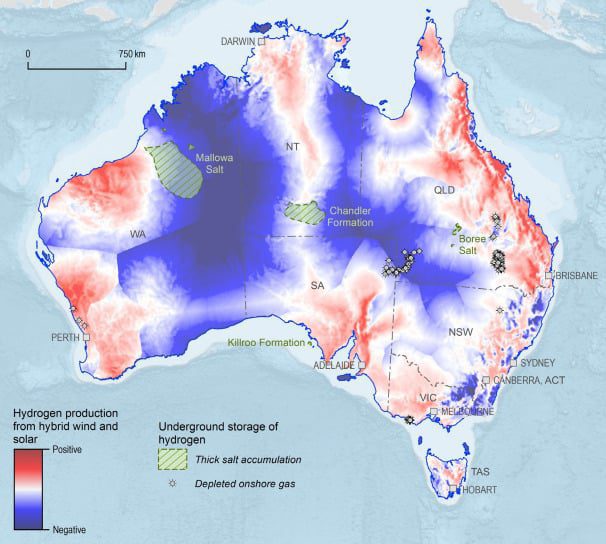

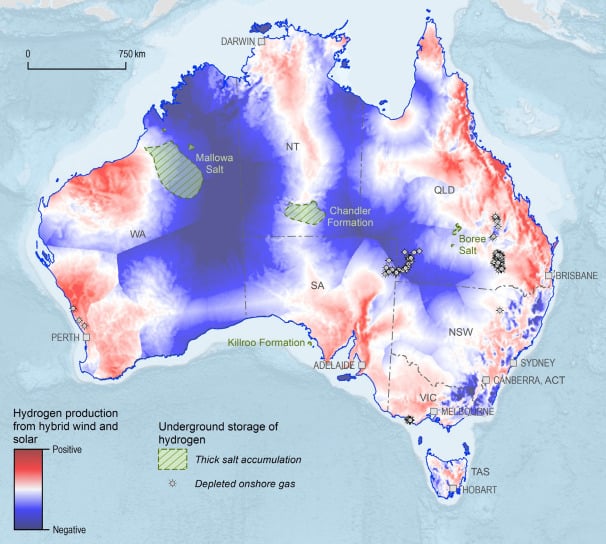

As seen in the image above, Australia has ample regions to develop green hydrogen projects via hybrid solar PV and wind projects. The majority are centred around the coastal regions of Western Australia, South Australia, New South Wales, Victoria, and Queensland, which grant acres of land to create large-scale projects.

It should also be noted that there are various opportunities to create underground salt cavern storage projects, primarily in the Mallowa Salt and the Chandler Formation. This is one of the cheapest and safest ways to store hydrogen, with the gas needing to be purified and compressed before it can be injected into the cavern.

At this current stage, the cost of renewable hydrogen production is high. The strategy details that the industry is nascent, and public investment in early movers will generate lessons that will reduce production costs over time.

It should also be noted that creating ultra-low-cost solar could grant opportunities in this field. Readers of PV Tech will be aware that the Australian Renewable Energy Agency (ARENA) is working towards its vision for ultra-low-cost solar, arguing that a ‘30-30-30’ approach to solar—representing 30% solar module efficiency and an installed cost of 30 cents per watt by 2030—could help Australia become a renewable energy superpower.

This would mean achieving a levelised cost of electricity below A$20 per megawatt hour by 2030 and could aid cost-competitive green hydrogen production.

Australia accounts for one-fifth of the world’s hydrogen pipeline

The latest government report determines that 20% of all announced hydrogen projects globally are in Australia. This pipeline is larger than for any other single country and represents approximately half of all export-oriented projects announced globally.

The pipeline is growing yearly and is valued at a minimum of A$225 billion (US$151 billion). It is overwhelmingly focused on renewable hydrogen production, as Australia’s extensive wind and solar resources “provide the foundation for producing low-cost renewable hydrogen”.

Australia’s strategy also states that domestically-produced hydrogen can be exported as an energy carrier to countries with limited ability to generate renewable electricity. It can also be exported in the form of low-emission products manufactured locally using hydrogen as a chemical or heat input for producing green metals, ammonia and low-carbon liquid fuels.

Despite these opportunities Australia has to capitalise on the growing hydrogen market globally, and the report notes that the country must “compete with other nations to be considered a global hydrogen leader”.

Chris Bowen, Australia’s minister for climate change and energy, believes the revitalised strategy is another step towards “unlocking Australian hydrogen’s world-class potential”.

“The enthusiasm of investors, businesses, communities and workers for hydrogen in Australia gives increasing confidence that we have what is needed to establish a world-leading hydrogen industry with bright opportunities. We can decarbonise new and existing manufacturing industries, like green metals and chemicals. We can set up new, large-scale clean exports,” Bowen said.

Five-yearly production milestones and a Hydrogen Production Tax Incentive

To help support growth in Australia’s hydrogen market, the new updated National Hydrogen Strategy details various key milestones, actions and targets to be achieved.

A key inclusion in the updated National Hydrogen Strategy is that it sets five-yearly production milestones to 2050, providing the trajectory needed to realise the Australian government’s goal of being a global hydrogen leader. Australia will target producing at least 15 million tonnes of hydrogen annually, with a stretch potential of 30 million tonnes annually, by 2050.

The government will also introduce an A$2 per kilogram Hydrogen Production Tax Incentive through Australia’s tax system. This incentive will provide time-limited, demand-driven production support to eligible producers of renewable hydrogen. This will form the basis of government support for the sector until 2040.

The strategy also reveals early information on the expanded Hydrogen Headstart programme. This programme will represent an early strategy action to address the current financial gap between the production cost and sale price of renewable hydrogen. It will focus on early-movers in the industry with well-developed projects.

Commenting on these two schemes, Bowned said: “These new policies unequivocally position Australia as one of the best places in the world to make green hydrogen. The challenge is now over to our emerging hydrogen industry to seize the moment.”

With the hydrogen and green hydrogen market still in its infancy, the strategy also aims to identify key sectors that could see early or high demand in the future.

For instance, the report states that green metals, ammonia, long-haul transportation, power generation, and grid support could increase demand or early-offtake for the clean energy carrier.

Iron ore mining has certainly seen a rise in the use of green hydrogen, particularly produced via solar PV projects. Last month, Australian mining giant Fortescue Metals Group started developing a US$50 million project in Western Australia aiming to harness solar PV to produce green hydrogen, which will be used to create green metals.

In the same month, Fortescue also said it would capitalise on China’s “insatiable demand for green products” through green metals production and exports, with hydrogen produced from solar PV and wind playing an important role.

Dino Otranto, CEO of Fortescue Metals, stated that “Australia is uniquely positioned for its next boom beyond commodities, but green commodities”, emphasising that this is why the organisation is putting “so much effort” into its Green Iron Plant, situated in Christmas Creek, Western Australia.

2030 hydrogen export target

Another key inclusion within Australia’s updated hydrogen strategy is the decision to implement a 2030 hydrogen export target, which it hopes will “provide a strong signal of Australia’s intention to continue supplying energy to the global market”.

Indeed, Australia aims to hit a base export target of 0.2 million tonnes of green hydrogen per year by 2030, with a stretch potential of 1.2 million tonnes per year. The strategy matches some of Australia’s key trade partners already with 2030 hydrogen targets.

Another key aspect of this, and to support the growing hydrogen market in Australia, is attracting international investment. For this, the strategy states that the country will continue to welcome international investors and ensure that the Australian Trade and Investment Commission (Austrade) and Net Zero Economy Agency (NZEA) will actively attract this investment.

The government also referenced the impending expansion of the Guarantee of Origin (GO) scheme, an internationally aligned initiative that measures and verifies the emissions intensity of the hydrogen produced.

The strategy declares that the scheme will be both scalable and expandable, enabling similar verification of products produced from hydrogen, including green metals and low-carbon liquid fuels.