During the reporting period, the prices of modules and wafers fell, the investment income of associated companies fell, and the impairment of inventories and other assets increased. The provision for impairment of inventory assets amounted to RMB2.649 billion and it is one of the important factors in the company’s transition from profit to loss.

Despite the decline in performance, the company still said it was maintaining a steady shipment growth. In Q1 2024, LONGi achieved wafer shipments of 26.74GW (external sales of 12.43GW), an increase of 12.26% year-on-year, external cell sales of 1.51GW and module shipments of 12.89GW (external sales of 12.84GW), an increase of 16.55% year-on-year.

LONGi led the loss, while Jinko, Trina Solar and Canadian Solar stayed profitable

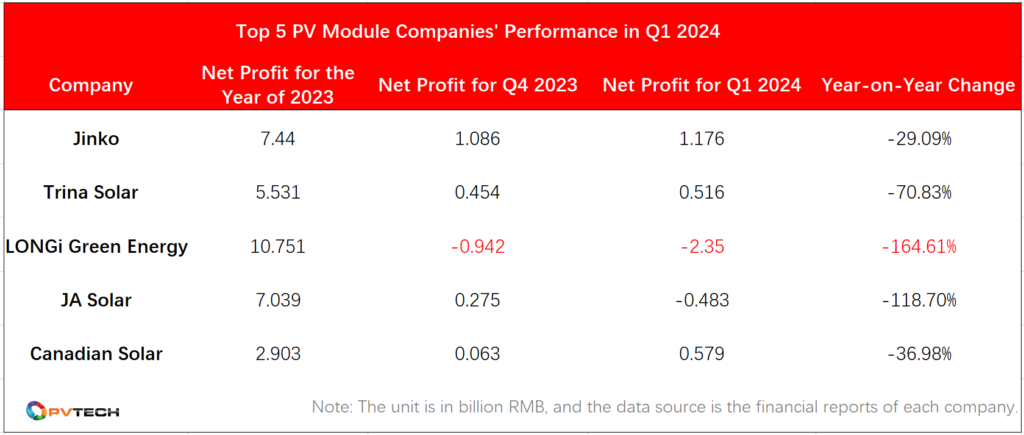

Alongside the release of LONGi’s quarterly report, the business operation conditions of the top five PV module companies in the industry (Jinko, LONGi, Trina Solar, JA Solar, Canadian Solar) are also revealed.

In fact, the trend of losses has been spreading among PV companies starting from Q4 2023. The price reduction on the industrial chain has brought very obvious operational pressures to the companies. Judging from the quarterly reports, the losses of these companies have increased, and the net profits of these leading PV companies in Q1 have all declined year-on-year.

Among them, after encountering its first loss in Q1 last year, LONGi’s loss in Q1 2024 further increased to RMB2.35 billion, a year-on-year decrease of 164.61%. Affected by the supply and demand of the PV industry chain, module selling prices fell year-on-year and the profitability of PV modules decreased. JA Solar’s performance in Q1 also declined with a loss of RMB483 million.

Some companies are still able to maintain a certain profit margin. Companies like Jinko and Trina Solar, which are among the first in China to deploy n-type technology on a large scale, have managed to achieve better profit performance than others in Q1. This is attributed to their proactive market positioning and technological reserves, which have provided them with an advantage during the current challenging period of profit-making.

Jinko’s quarterly report showed that in Q1 2024, the company achieved operating income of RMB23.083 billion, down 0.3% year-on-year; the net profit attributable to shareholders of listed companies was RMB1.176 billion, down 29.09% year-on-year.

Jinko has maintained an industry-leading scale in shipments. From January to March 2024, the company’s total shipments were 21,907MW, of which module shipments amounted to 19,993MW, and wafer and cell shipments amounted to 1,914MW. The total shipments increased by 51.19% compared to the same period last year. As of the end of the reporting period, the company’s cumulative global shipments of PV modules have exceeded 236GW. The company expects to ship 24GW-26GW of modules in Q2.

Trina Solar’s report of Q1 2024 showed that the revenue for the reporting period was about RMB18.256 billion, a decrease of 14.37% year-on-year; the net profit attributable to shareholders of listed companies was about RMB516 million, a decrease of 70.83% year-on-year. Although net profit is also decreasing, it is already rare to maintain positive profits in the downturn of the PV industry.

In addition, it is worth noting that as of the end of March 2024, the cumulative global module shipments of Trina Solar exceeded 205GW, of which the cumulative shipments of 210mm modules exceeded 120GW, and 210mm module shipments continued to maintain the world’s first place.

Canadian Solar is also one of the few companies that maintains a positive profit margin. In Q1 2024, Canadian Solar achieved revenue of RMB9.6 billion and a net profit of RMB579 million, down 18.88% and 36.98%, respectively, year-on-year.

Canadian Solar said that from January to March 2024, taking into account the market price levels and the annual shipment target guidance, the company had made a balance between price and quantity, and achieved a module shipment of 6.3GW, which represents a 3.28% increase over the same period last year, of which the North American market accounted for more than 20%.

During the same period, the company confirmed revenue from 1GWh of storage products shipped. The storage business, as the company’s second main business, started to scale up this year. The operating income of the storage business in a single quarter has basically been the same as that of the whole year of 2023.

Analysts observing the operations of these PV companies have pointed out that since Q1 2024, companies have faced a severe test due to the slow demand recovery. Companies with a large proportion of P-type products, due to the lack of irreplaceability in technology and relatively weak market, find it more difficult during the downturn phase, with lower operational rates and more severe impairment losses on assets. LONGi is the company with the largest loss among these five, which is not unrelated to the aforementioned factors.

Looking ahead, in H1 2024, the recovery in demand is not expected to accelerate significantly. It is expected that in H2 of this year, as inventory depletion comes to an end, the demand is likely to rebound year-on-year.