European developers will be the primary beneficiaries of current higher wholesale prices and favourable economics for renewables projects over the next decade, according to a report from advisory firm Edison Group.

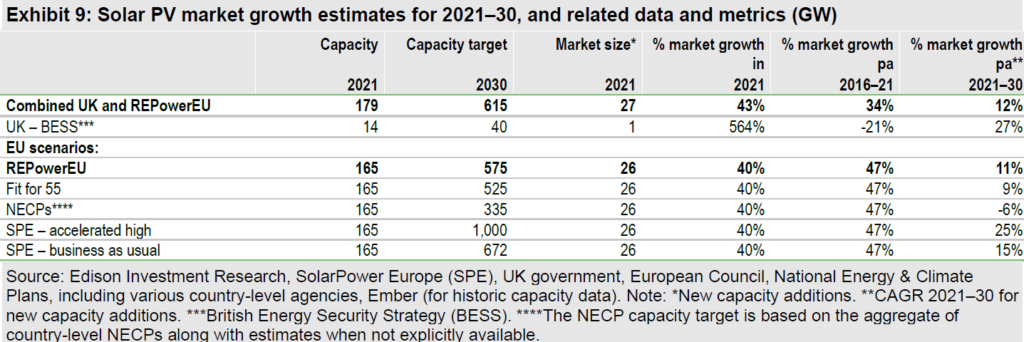

The solar market in itself would see a compound annual growth rate (CAGR) of 12% over this decade, with developers being able to see double-digit returns on capital, helped by long-term growth in European renewables (mainly solar and wind) and thanks to a favourable regulatory environment.

The report outlines that the most capital-intensive model for developers is the development of greenfield sites, where developers who build renewable assets from scratch without selling them afterwards will get a better return on their investment.

Moreover, developers able to finance assets through their own balance sheets will also benefit from the current wholesale high prices as well as developers securing power purchase agreements (PPAs) for longer than 10 years due to high market prices, said the report.

Interest in long-term PPAs among the commercial and industrial (C&I) sector and corporate entities has increased companies seek to reduce their greenhouse gas emissions and mitigate energy price volatility.

The PPA market has almost doubled between 2020 and 2021 to nearly 7GW, said the report, with corporate PPAs accounting for just 9% of annual installations for solar PV, compared to 30% for wind.

Even if renewable projects can be financially viable without any government subsidies, different regulatory support – accelerated project approvals, encouraging corporate PPAs, market or grid investments – could enhance project economics, said Edison Group.

One of the examples shown in the report is how Poland’s subsidy for rooftop solar helped the market grow in comparison to the wind industry, which halted due to an unfavourable policy.

National-level policy, however, needs to urgently increase its policy support in terms of investment in grid and energy storage, as the current policies imply an annual decrease in the growth by 6% as shown in the chart below.

The EU and the UK will need to invest “hundreds of billions of euros” to support the power system if they aim to reach their renewables target by the end of the decade, with short, medium and large duration storage solutions needed to improve the grid.

James Magness, director of energy & resources at Edison Group, said: “The geopolitical crisis in Europe has accelerated the need for European countries to decarbonise power generation.

“With the European energy crisis and Russia’s invasion of Ukraine resulting in a rise in fuel prices – and we believe they will remain structurally higher in the long-term – there has never been more opportunity for renewable energy developers to benefit, particularly in the solar and wind sectors.”