PV Tech reported that India’s rooftop solar potential could reach 32GW with subsidy, according to a recent report by policy research institute Council on Energy, Environment and Water (CEEW).

The decreased utility-scale solar installations were due to auctions for many solar tenders that had not been completed yet. Furthermore, JMK Research said the Ministry of New and Renewable Energy (MNRE) had extended the commissioning timelines for the solar, wind, and hybrid projects. In addition, delays in approvals for power purchase agreements (PPAs) from state agencies were additional factors contributing to the slowdown.

Geographically, Rajasthan led utility-scale solar installations with a total capacity of 1.5GW, followed by Gujarat (1.2GW), Maharashtra (0.91GW) and Tamil Nadu (0.58GW).

Installations of rooftop solar in the first three quarters of this year increased by 126% year-on-year. Reduced cost of solar modules contributed to the significant increase. The energy analyst said the increase would likely continue in the near to medium term.

Karnataka (1.16GW), Gujarat (692MW), and Maharashtra (331MW) were the leading states in rooftop solar installations during the first three quarters of 2023.

As of the end of September, Rajasthan, Gujarat, Karnataka, and Tamil Nadu collectively accounted for 62.6% of the total solar capacity installed in India.

For 2023, about 11GW of new solar capacity is expected to be installed in India, including 7GW from utility-scale, 3.5GW from rooftop solar, and 500MW from off-grid solar.

As of 30 September, India’s cumulative solar installations reached 71.8GW, accounting for a 54.5% share of the total renewables mix.

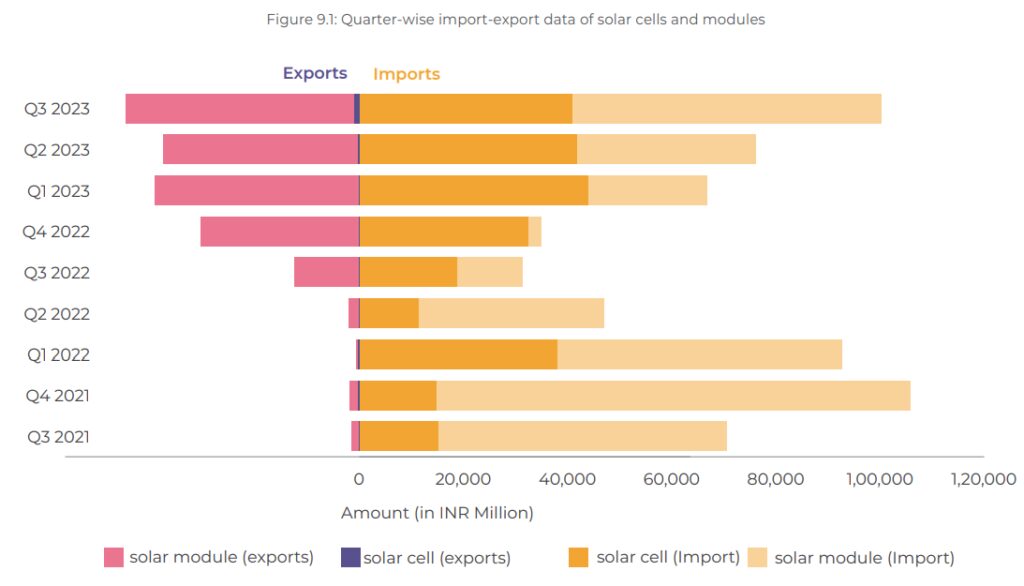

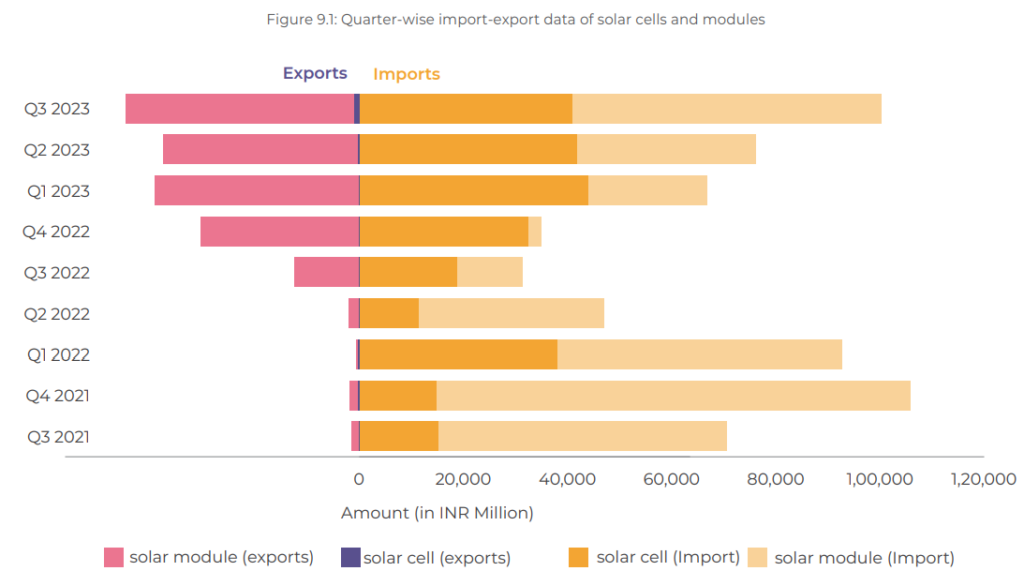

Solar module imports

Meanwhile, in Q3, solar module imports in India increased by 73% compared to the previous quarter due to the Indian government’s decision to extend the implementation of the Approved List of Models and Manufacturers (ALMM). The order states that only the listed solar PV models and module manufacturers can be used for solar projects in India.

In March 2023, the Indian government said solar projects commissioned by 31 March 2024 would be exempted from procuring modules listed under ALMM.

Lastly, Waaree Energies exported more than 700MW of modules in Q3 2023, the highest among all Indian solar manufacturers. The company was followed by Adani (more than 600MW) and Vikram Solar (over 100MW). Adani exported 73% of its total module production in Q3, the highest among all Indian solar manufactures. Waaree Energies came second (63%), followed by Vikram Solar (58%).

Previously, JMK Research also published a report about module exports from Indian solar manufacturers. In its report, New Paradigms of Global Solar Supply Chain, the company predicted that India’s solar module exports to the US and Europe will likely peak in 2025 and experience a decline starting from 2026 as domestic manufacturing plants will be operational in these regions.