The only exception to this is in north-eastern states and ‘special’ category states that are already earmarked to receive greater government subsidies to cover the cost of rooftop PV additions. In these states, the minimum project size is 30MW of solar, plus 15MW/60MWh of batteries.

Rooftop solar is set to be a crucial component of the Indian renewable energy transition, following the launch of last year’s PM-Surya Ghar Muft Bijli Yojna – Prime Minister’s Rooftop Solar: Free Electricity Scheme – a US$8.9 billion investment to support the installation of new rooftop projects. In January this year, minister for new and renewable energy Pralhad Joshi noted that the scheme had already delivered 850,000 rooftop installations, covering ten million homes.

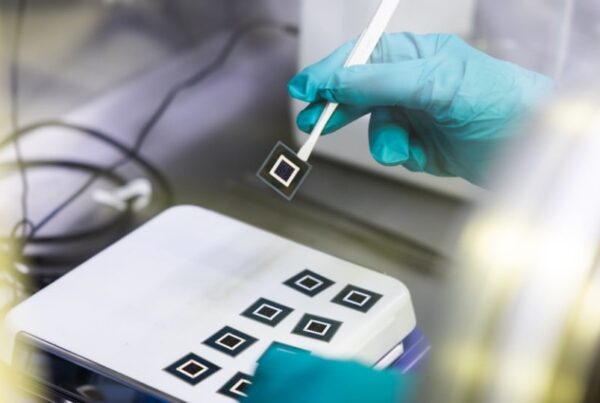

However, NHPC India notes that its tender process would be “technology agnostic”, suggesting that it has no preference for the type or scale of solar and storage projects to be deployed at its sites. The organisation specifies that crystalline silicon and thin-film products can be used in bids, and the only technical requirement is that the proposed technology is “commercially established”, as this is an initiative that seeks to deliver large-scale renewable electricity quickly, rather than be a testing ground for emerging solar technologies. Applicants are also welcome to submit bids with or without trackers.

Bidders to build substation infrastructure

Individual bidders will be required to complete much of the administrative work for their projects, including securing approvals and permits from local government for their construction. Successful bidders will also be responsible for building the “dedicated transmission network” to connect their projects to India’s Inter State Transmission System (ISTS).

A lack of available grid capacity looms large in the Indian renewable power sector, with the government expecting to invest US$29.2 billion into grid expansion work by the end of the decade.

Vibhuti Garg, director of South Asia at the Institute for Energy Economics and Financial Analysis (IEEFA), told PV Tech Premium last year that without significant investment, India’s renewable capacity additions would experience delays, specifically because there is a “lack of adequate substations to connect to the ISTS”, and the latest NHPC India tender looks to put responsibly for delivering these substations on individual project developers.

This is particularly significant considering the rapid pace of new solar power additions in India. According to Mercom India Research, India added a record 25.2GW of new PV capacity in 2024, a 204% year-on-year increase, and close to three-quarters of all new power capacity additions last year. With the government looking to add 500GW of non-fossil fuel generation capacity by 2030, significant solar capacity is expected to come online in the coming years, and the Indian grid will need to be expanded to accommodate these projects.