Solar polysilicon, wafer and cell prices have all risen once again in the past week as demand continued to outstrip supply, with COVID-19 lockdowns in China continuing to disrupt the value chain.

Last week saw wafer providers LONGi and Zhonghuan Semiconductor (TZS) and cell producer Tongwei all instigate another round of price increases, the latest in a string of hikes to the cost of solar PV materials and components since the turn of the year.

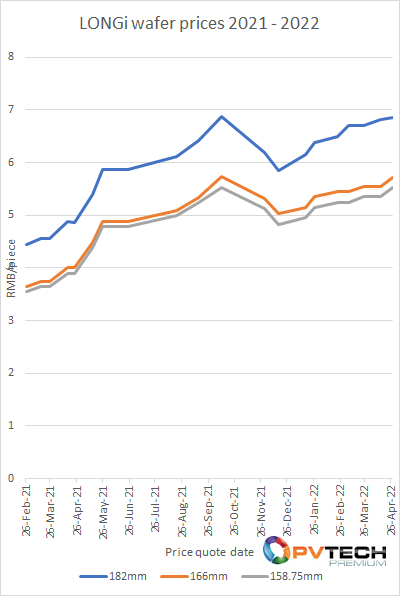

LONGi increased the price of its wafers across the board. 182mm (M10) wafers rose marginally to RMB6.86 (US$ ) per piece – the company having only previously increased the prices of 182mm wafers two weeks prior – while more material price increases were recorded for its 166mm and 158.75mm wafers.

TZS meanwhile also increased the prices of its wafers, rising around 1% compared to the previous price quote published on 2 April 2022.

PV cell producer Tongwei increased its prices for May last week, confirming marginal increases to prices for its 210mm and 182mm cells. Both prices increased by RMB0.01/W – to RMB1.14/W and RMB1.18/W respectively – compared to Tongwei’s previous pricing update on 14 April 2022. Prices for 166mm cells remained at RMB1.17/W.

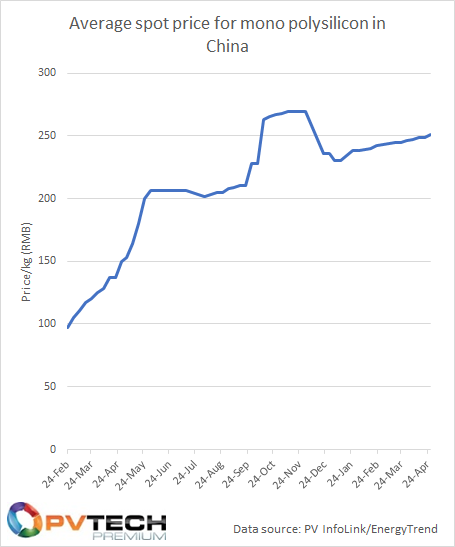

Polysilicon pricing, meanwhile, rose once again, the most recent average prices for the material, as published by PVInfoLink and EnergyTrend last week, having risen above the RMB250/kg – inclusive of China’s 20% sales tax – for the first time since December 2021.

PV Tech Premium’s PV Price Watch feature has today covered in more detail the reasons behind this most recent spate of price increases and the impact it is having on module pricing in China.