Renewables developer Mytilineos has seen its profits soar to €166 million (US$168.56 million) in H1 2022, with renewables sales nearly doubling.

Net profit more than doubled with a 116% increase from H1 2021 when the Greek developer’s profit reached €77 million (US$78.5 million).

Similarly, turnover and EBITDA reached €2,154 million and €293 million for H1 2022, respectively – an increase of 117% and 88% from H1 2021 – led by strong performance from all its business units, with metallurgy as well as power & gas displaying “historically” high performance.

Evangelos Mytilineos, chairman and CEO at Mytilineos, said: “The H1 2022 financial performance, reconfirms Mytilineos’ ability to respond promptly and successfully even under the most adverse economic conditions.”

The firm’s renewables unit recorded a strong performance during H1 2022 too, with a turnover of €229 million, almost doubling the €118 million it recorded for the same period last year.

During the second quarter of the year, the company managed the sale of two projects in the UK for a capacity of 100MW, while in June it announced the development of 750MW+ of solar PV in Chile as well as securing a 10-year PPA with Enel Chile for the sale of 1.1TWh/year.

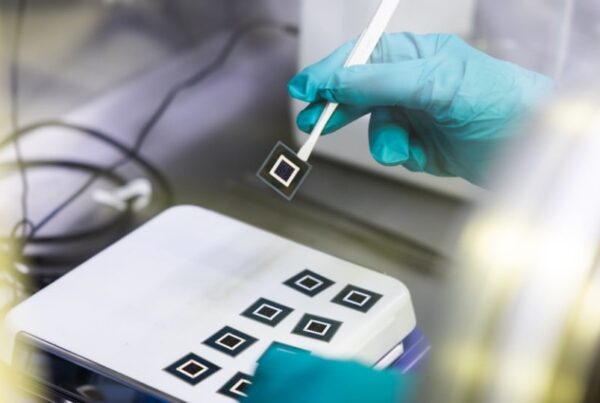

The renewables & storage development (RSD) unit’s build, operate and transfer department reached a current capacity of 6.2GW in various stages of development, of which 123MW are in operation and 665MW under construction.

For the second half of the year the company expects substantial agreements for the sale of solar PV plants with total capacity exceeding 450MW and driving RSD to “new levels of profitability, significantly higher than previous years.”

Meanwhile work on its backlog of third-party engineering, procurement and construction (EPC) contracts are progressing well in Spain, UK, Greece, Uzbekistan and Chile, with contracted backlog standing at €290 million and a further €161 million in final negotiation phase, the company said.

While “the economic environment remains quite volatile and full of uncertainties”, the company said it has already set “the foundations for achieving historically high financial performance in 2022.”