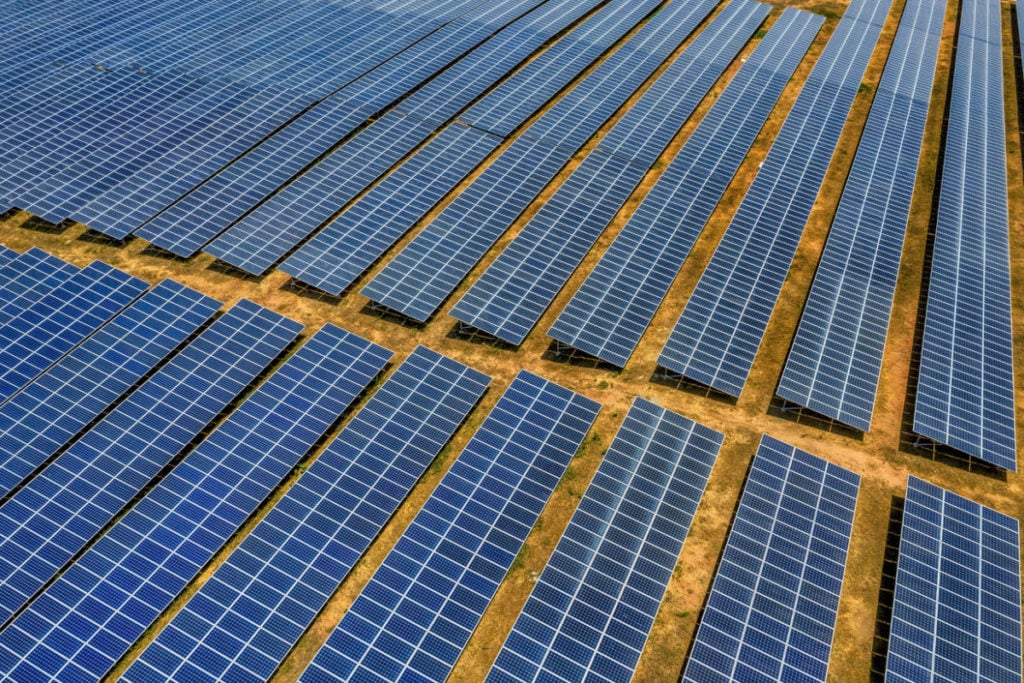

Masdar has reached financial close on three PV facilities in Uzbekistan with a combined capacity of approximately 877MW.

The projects will be under construction in the first half of this year and are expected to begin operations in 2024.

Financing was secured from the Asian Infrastructure Investment Bank (AIIB), Asian Development Bank, the European Investment Bank and the European Bank for Reconstruction and Development.

In a release, the AIIB confirmed that it had signed three project finance loan agreements with Masdar to the tune of US$83.6 million as part of a larger US$396.4 million debt financing towards the projects.

Once completed, Masdar said that this portfolio will be the largest solar development in the Central Asian region. They are to be located in the Samarkand, Djizzakh and Surkhandarya regions.

Uzbekistan has a target of 7GW of deployed solar PV by 2030, as well as meeting 25% of its electricity needs with renewable generation.

Masdar already operates in the country, with over 700MW of PV already operational or in development through agreements with the Ministry of Investments, Industry and Trade and the national electricity grid.

Niall Hannigan, CFO of Masdar said: “Reaching this milestone for all three projects is a proud moment for Masdar and a key stage for Uzbekistan’s clean energy journey. Masdar is already playing a significant role in supporting the Government of Uzbekistan’s ambitious renewable energy objectives, and we look forward to continuing to grow our portfolio of projects in this key strategic market.”

Masdar spoke with PV Tech Premium last week about its plans for Central Asia and the fact that the region must invest heavily in transmission infrastructure to enable its renewable energy plans.

These Uzbekistan projects received capital from both Masdar and the AIIB through the Energy Transition Accelerator Financing (ETAF) platform established by the International Renewable Energy Agency (IRENA). The platform aims to channel financing towards renewable energy development in emerging markets and economies.

Both Masdar and the AIIB joined the programme at last year’s COP27 conference alongside insurance firm Swiss Re, committing to US$200 million and US$300 million respectively.