Utility-scale renewables developer Intersect Power has secured US$3.1 billion in project financing to complete its 2.2GW near-term clean energy portfolio in the US.

The transactions cover construction financing, tax equity, operational letters of credit and portfolio level term debt with an aggregate of US$2.4 billion for new financing commitments and the allocation of US$675 million for the construction and operation of four solar projects with a capacity of 1.5GW of solar PV and a 1GWh battery energy storage system (BESS).

All four projects are expected to be operational in 2023, with two – Lumina I and Lumina II with 840MWp capacity – located in Texas, while the other two solar-plus-storage projects – Oberon I and Oberon II with 685MWp solar PV and 1GWh of BESS – in the Californian desert. Oberon I received construction approval from the US Bureau of Land Management (BLM) earlier this year.

These projects are part of Intersect’s 2.2GW near-term PV portfolio and 1.4GWh storage pipeline for which the company had already secured US$2.6 billion of financing last year.

Moreover, in June 2022 the renewables developer closed another funding of US$750 million to increase its renewables, energy storage and green hydrogen portfolio beyond 8GW.

“These closings culminate a multi-year process raising more than US$6 billion to build out one of the largest solar-plus-storage portfolios our country has seen to date which serves as a platform for future growth into green hydrogen and other decarbonisation technologies,” said Sheldon Kimber, CEO of Intersect Power.

The construction financing, with approximately US$1.6 billion, was co-lead by MUFG and Santander and included NORD/LB, KeyBanc Capital Markets, Helaba, CoBank, Bank of America and Zions Bancorporation as joint lead arrangers, while CoBank ACB provided operational letters of credit to the Oberon I and II and the Lumina II projects.

Concurrent with the closing of the construction financing, Intersect secured roughly US$775 million of commitments from tax equity investors, including Morgan Stanley Renewables for Oberon II, a Fortune 100 technology company for Lumina I, and US Bank for Oberon I and Lumina II. While the US$675 million funding for the four solar projects was provided by HPS Investment Partners and Co-Investors.

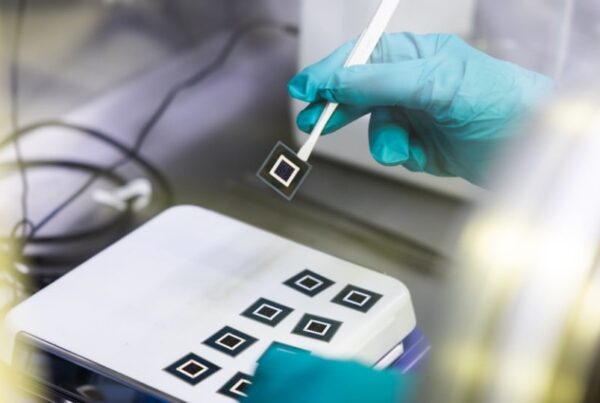

Furthermore, the developer landed an agreement supply with First Solar in August for 2.4GW of its thin film PV modules which are scheduled to be delivered from 2024 to 2026.