This values the company at approximately NOK925 million (US$88.8 million) based on over 420 million outstanding shares.

REC Silicon’s board of directors “unanimously” recommended that shareholders accept the offer and sell their shares to Hanwha.

Kurt Levens, CEO of REC Silicon, said the offer was “firmly in [the company’s] interest and in the interests of all the company’s stakeholders, including the shareholders.”

Ki Won Yang, CEO of the Hanwha Corporation, said: “Hanwha, recognising its responsibility as REC Silicon ASA’s largest shareholder amid the company’s deep financial distress and strategic challenges, has decided to launch a voluntary tender offer to acquire all shares and delist REC from the Oslo Stock Exchange; following delisting, Hanwha plans to provide adequate financial support and streamline governance to help stabilise operations.”

Polysilicon shutdown

In early January, REC Silicon abandoned operations at its US polysilicon production facility in Moses Lake, Washington. This was after a supply deal with Hanwha’s solar PV manufacturing subsidiary, QCells, was abandoned due to concerns over the quality of REC’s polysilicon product.

Later that month, REC secured a US$40 million loan from Hanwha to aid in the shutdown of the facility.

The news of the shutdown raised eyebrows across the solar industry and among REC Silicon’s minority shareholders (premium access). Technical experts were suspicious of the claims of product impurity, and minority shareholders raised concerns over Hanwha’s involvement on ‘both sides’ of the shutdown, given its ownership of Qcells and its significant shareholding in REC Silicon.

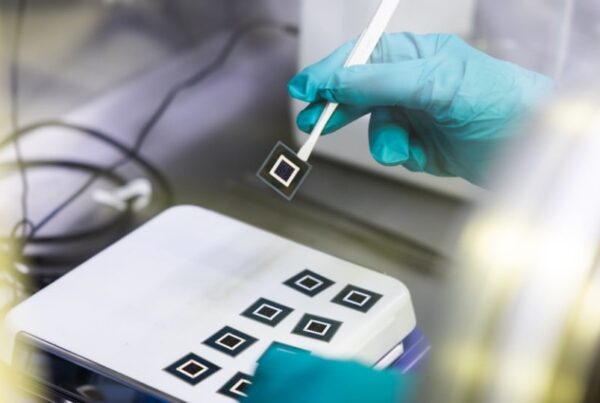

REC produced solar-grade polysilicon with the fluidised bed reactor (FBR) method, which is generally cheaper but often produces lower-purity products than the more widely-used Siemens process.

Hanwha signed a supply deal with Malaysian polysilicon producer OCI Holdings within days of terminating the REC Silicon deal.

‘Scandalously low’

In response to Hanwha’s NOK925 million buyout offer of REC Silicon, a group of REC’s minority shareholders based in Norway said the deal was “scandalously low”.

The REC Silicon Investor Hub, which claims to represent the interests of shareholders holding close to 20% of REC shares (around 83 million shares), posted an article over the weekend titled “Stop the Steal”, in which it laid out its resistance to the deal.

The article said that the value of REC Silicon and its underlying assets is “far higher than the lowball offer” issued by Hanwha.

“Levens, the CEO, was asked some time ago about the ‘replacement value’ for [production facilities at] Moses Lake and Butte – his answer was US$3 billion,” the article reads.

“Butte is in production and holds significant value, while Moses Lake likely has a lower value until the plant is fully operational – in a US market now building trade barriers against Asian polysilicon.”

REC produces electricity-grade silicon and silane gas at its facility in Butte, Montana.

“Even after subtracting US$400 million in debt, it is obvious that the underlying values – spread across 420 million shares – are far higher than the lowball offer,” the article said.

The shareholder group website was founded on 4 January 2025, after the closure of Moses Lake was announced and the deal with Hanwha Qcells terminated. It has previously raised concerns over the “black box of secrecy” surrounding Hanwha’s involvement in REC Silicon and accused the company and its largest shareholder of facilitating “asymmetric access to information between Hanwha and minority shareholders.”

This article was amended to show that the The REC Silicon Investor Hub represents minority shareholders with close to 20% of REC shares.