To reach its 2030 and 2035 targets, the country aims to add at least 5.5GW of solar capacity per year between 2025 and 2027, up from 3GW per year in the previous PPE, before reaching 7.5GW of annual added capacity in 2029 and 2030.

Data from French transmission system operator RTE puts the country’s installed solar PV capacity at 23.7GW, as of the end of 2024. Last year, the country added 4.7GW of solar PV, which puts it closer to the new annual target set for 2025 than the previous one set at 3GW.

Utility-scale installations represent more than half of the operational solar parks in France, with 54%. Of that percentage 38% is for ground-mounted solar PV and 16% for rooftop PV. The bulk of the other installed capacity comes from small and medium rooftop installations which represent 41%, while small-scale ground-mounted PV represents 5%.

Ground-mounted and rooftop PV tenders

Tenders will be a contributing factor to reach these targets with the launch of ground-mounted tenders and rooftop ones between 2025 and 2035.

For ground-mounted tenders, two auctions will be held per year, seeking 1GW of capacity each time. These will be launched from the first half of this year and represent a slight increase from the previous tenders, which sought 925MW of solar PV.

Rooftop tenders will see their capacity auctioned reduced to 300MW – most previous tenders were capped at 400MW – with three auctions to be held each year. The reduction in capacity auctioned for rooftop solar is no surprise, as previous tenders failed to reach the minimum cap, with only two rooftop tenders awarding more than 300MW.

For ground-mounted it is a different picture, with the last two tenders awarding nearly 1GW, with the last one ending up oversubscribed, each and much closer to the new allotted capacity.

On top of these two specific solar PV tenders, a technology-neutral tender will be held annually and will seek around 500MW of solar PV, wind and hydropower. No mention of battery storage was made for this tender.

Furthermore, agriPV projects will be supported through the ground-mounted and rooftop PV tenders or through a dedicated call for tenders.

By the end of 2023, France had installed 19.3GW of solar PV capacity, 1.3GW short of the target it had set in its previous programme.

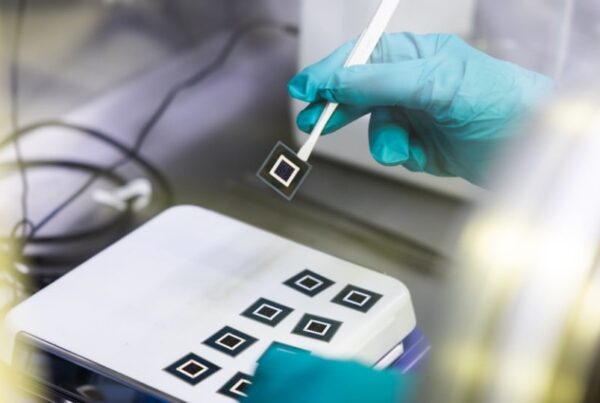

10GW of solar cell and module manufacturing by 2035

Moreover, the country also targets between 5GW to 10GW of annual solar cell and module manufacturing capacity by 2035, while reaching 3GW to 5GW of annual nameplate production for ingots and wafers.

However, the draft does not explain if any programmes will be launched to bolster a domestic manufacturing capacity in the country, which recently saw the closure of EDF Renewables PV manufacturing subsidiary, Photowatt.

French manufacturing startup Carbon sought to buy Photowatt last year with no avail, as the company plans to build a solar cell and module assembly plant in France with an annual nameplate capacity of 5GW and 3.5GW, respectively. The company aims to start production of a 500MW module assembly line in the autumn of this year.

Carbon will not be the only French manufacturer aiming to build manufacturing in France, with Holosolis unveiling in 2023 a plan to build a 5GW module assembly plant. More recently, Chinese solar manufacturer DAS Solar announced the construction of a 3GW module assembly plant in the eastern region of Bourgogne-Franche-Comté. Consisting of three module assembly lines with an annual nameplate of 1GW, the first modules are expected to begin production this year.

French independent power producer (IPP) Reden recently launched a 200MW module assembly line. However, the company told PV Tech Premium in December 2024 that it does not aim to become a solar manufacturer and remains, first and foremost, an IPP.