“The United States produces some of the cleanest and most efficient energy in the world, and an all-of-the-above approach—including support for traditional and renewable energy sources—has long been a hallmark of our energy strategy,” the Senators wrote.

“To that end, many American companies have made substantial investments in domestic energy production and infrastructure based on the current energy tax framework. A wholesale repeal, or the termination of certain individual credits, would create uncertainty, jeopardising capital allocation, long-term project planning, and job creation in the energy sector and across our broader economy.”

The IRA tax credit scheme introduced by Joe Biden in 2022 is the leading tax credit mechanism for new energy projects. The act allocated US$369 billion in incentives to US energy producers and manufacturers, with an emphasis on renewable energy.

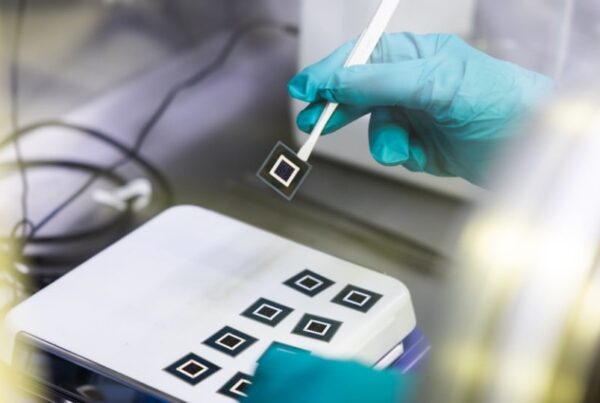

Since the passage of the IRA, the US has reached 50GW of annual nameplate solar module production capacity and installed around the same amount of new PV generation capacity in 2024. Installations of battery energy storage have also increased dramatically, reaching a total of 26GW in 2024 according to the US Energy Information Administration.

The letter continued: “Furthermore, as the Trump Administration continues its efforts to restore manufacturing and secure supply chains, maintaining a reliable energy tax environment is essential to attracting long-term investment, particularly in states that offer business-friendly climates.”

Red states have benefitted from many of the clean energy manufacturing announcements and project developments in recent years.

IRA uncertainty

A report from non-profit group the American Council on Renewable Energy (ACORE) said that uncertainty over tax credits risked ‘tens of billions’ in US investment and economic growth. Its data found that 84% of investors and 73% of developers would decrease their activity in renewable energy if faced with an uncertain tax credit environment.

Since Donald Trump’s second entry into the Oval Office, many renewables industry observers have maintained a cautious optimism over the future of the IRA. Despite the president’s association with the extremely conservative “Project 2025” which described the “Biden Administration’s assault on the energy sector…forcing the economy to build out and rely on unreliable renewables,” his increased economic protectionism and previous references to the climate change “hoax”, the renewables industry has repeatedly said that a full IRA repeal is unlikely.

PV Tech has previously heard that the economic growth facilitated by the IRA, its job creation, measures to enable US energy security through renewables and previous bipartisan political support for the bill will be its saving grace.

However, the publication of this open letter perhaps speaks to coming fights over the IRA’s status.

The senators referenced the “budget reconciliation” process, where a Trump-backed budget bill which passed the House of Representatives with US$5 trillion in tax cuts and US$1.5 trillion cuts in government spending will need to be combined with a milder proposal from the Senate.

The letter said: “As discussions on tax policy continue, we stand ready to work with you to identify waste, fraud, abuse, and necessary reforms. We believe the final reconciliation bill can support smart policies that enable private sector investment in domestic energy to help meet future US energy needs and strengthen the global competitiveness of American companies.”