April 14 (Renewables Now) – BlackRock Real Assets and Abu Dhabi’s Mubadala Investment Company will invest INR 40 billion (USD 525m/EUR 485m) in the renewable energy business of India’s Tata Power Company Ltd (NSE:TATAPOWER) to fund its “aggressive” growth plans, the Indian power company said today.

The investment is led by BlackRock Real Assets, with Mubadala as co-investor. It will see the pair get equity/compulsorily convertible instruments for a 10.53% interest in Tata Power Renewable Energy Ltd, with their final shareholding to range from 9.76% to 11.43% upon final conversion.

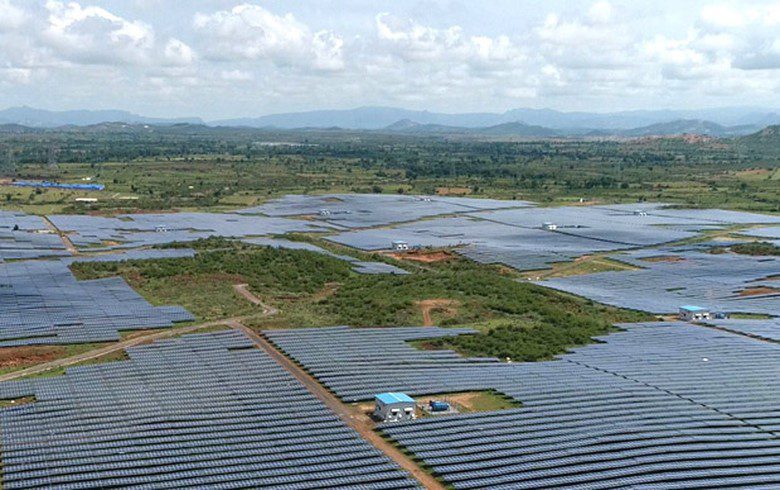

Tata Power Renewables now has about 4.9 GW of renewable energy assets and it aims to reach over 20 GW in the next five years, along with becoming a market leader in India in the rooftop and electric vehicle charging sectors.

The deal, which is subject to conditions precedent and customary regulatory approvals, implies a base equity valuation of INR 340 billion, according to the announcement. The first tranche of the investment is expected to be completed by June 2022 and the remainder by end-2022.

Tata Power said the investment will help it create a comprehensive renewable energy platform, spanning all of its renewable energy businesses, including utility-scale solar, wind and hybrid generation assets; solar cell and module manufacturing; engineering, procurement and construction (EPC) contracting; rooftop solar infrastructure; solar pumps and electric vehicle charging infrastructure.

The move comes as India is expected to increase its renewables capacity from 150 GW now to 500 GW by 2030.

“With one of the largest portfolios of solar and wind assets in the country and a very experienced management team, Tata Power Renewables is at the forefront of India’s ambition to secure greater energy stability for its citizens while positioning its economy for a low carbon future,” said Anne Valentine Andrews, BlackRock’s global head of Real Assets.

(INR 1 = USD 0.013/EUR 0.012)

Join Renewables Now’s free daily newsletter now!