“We cannot thank our financing partners enough for their invaluable support as we complete our first project in our home state of Missouri,” said Max Whitacre, EVP of project finance for Birch Creek. “It is such a pleasure working with the Celtic and West Town teams, and we look forward to continued financings with both relationships as we continue to build out our IPP.”

The news follows Birch Creek’s commissioning of the 49MW Earp Solar project in Illinois in June this year, in which Celtic Bank was also involved. The company has developed over 1.7GW of solar projects in the last five years and has a portfolio of 14.2GW of solar and storage projects in what it calls “various stages of development”.

The US solar sector is growing at a rapid pace, with figures from the Federal Energy Regulatory Commission (FERC) reporting that the US installed 14.4GW of operating capacity in the first five months of this year, more than any other technology. Much of this growth was sparked by the passage of the Inflation Reduction Act (IRA) in 2022, with the US Solar Energy Industries Association (SEIA) and Wood Mackenzie reporting that, as of May this year, more than one-quarter of all operational US solar projects had been commissioned since the implementation of the IRA.

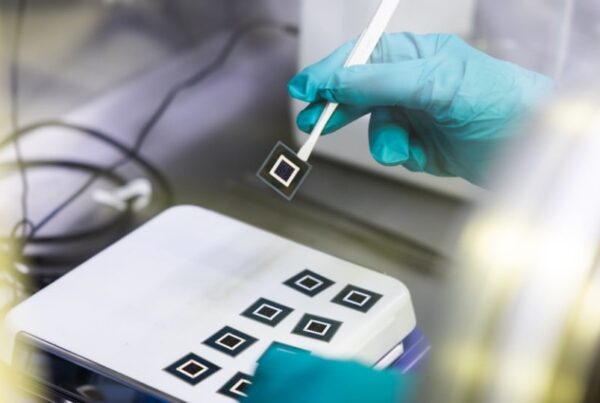

A key component of the IRA is encouraging operators to use US-made products in the renewable energy sector. In April, Birch Creek announced that it had ordered 547MW of Series 6 modules from US manufacturer First Solar as it looks to expand its portfolio and support the growing US upstream sector.

“We are pleased to establish this relationship with First Solar, which we expect will enable certainty of module supply for a critical part of our development pipeline,” said Dan Siegel, Birch Creek CEO, at the time of the deal. “By choosing to buy our modules from First Solar, we are strengthening our domestic content strategy with a trusted partner that delivers a competitive product.”