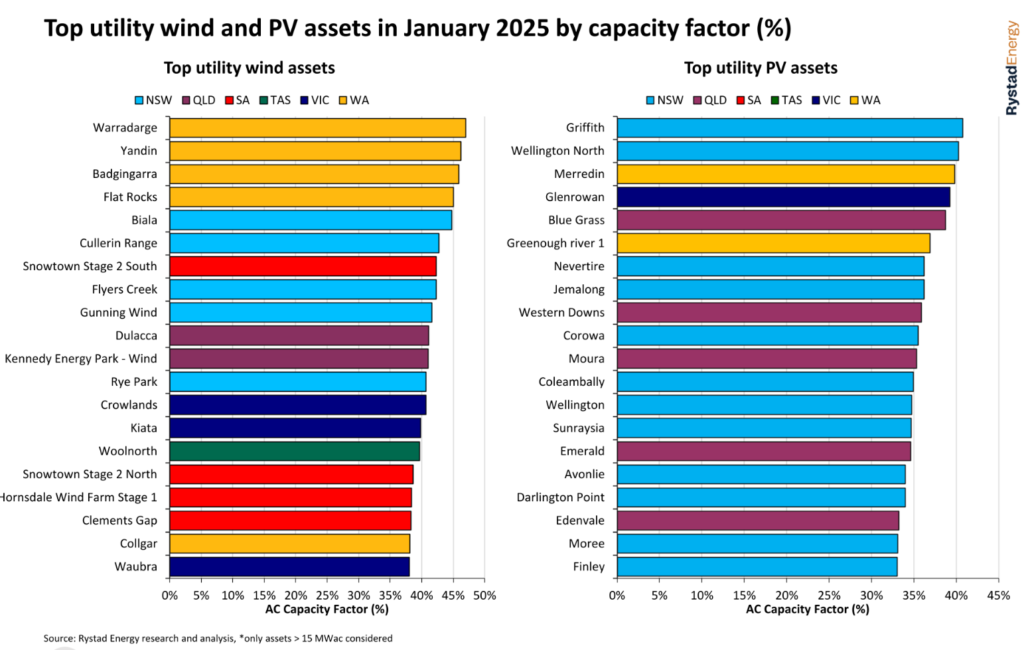

Whilst December 2024 was a month dominated by solar PV assets in New South Wales, January 2025 features a mix of New South Wales, Western Australia, Victoria and Queensland.

Rounding off the top five assets is Beijing Energy International (BJEI) Australia’s 300MW Wellington North, acquired from Lightsource bp in 2023, Sun Energy’s 100MW Merredin plant in Western Australia, also featuring in the top five for the second month running, CIMIC Group’s 130MW Glenrowan PV plant in Victoria and Spanish solar PV developer X-Elio’s 200MW Blue Grass plant in Queensland.

Dixon previously said that, on an annual basis, renewable energy generation across the National Electricity Market (NEM) and Wholesale Electricity Market (WEM) reached 92TWh or 39% of total generation.

Casting an eye to the future, Dixon predicts that this 39% figure will increase to around 43-45% in 2025, with several gigawatts of solar PV, including rooftop and utility, as well as wind capacity, to be energised and commissioned across 2025. This will also be aided by utility-scale battery energy storage capacity doubling to over 6GW by year-end.

Grid-scale solar PV on Australia’s NEM sets new quarterly high with over 2GW

According to the Australian Energy Market Operator’s (AEMO) latest Quarterly Energy Dynamics, which encompasses Q4 of 2024, grid-scale solar PV output achieved a new quarterly high average on the NEM, reaching 2,212MW, an increase of 9% YoY.

AEMO said variable renewable energy generation from grid-scale solar PV rose by 259MW YoY due to newly connected facilities and those progressing through the commissioning processes.

This increase in generation capacity was cited as a result of BJEI’s Wellington North PV plant and Fotowatio Renewable Ventures Australia’s 353MW Walla Walla PV plant, which was energised in November 2024.

Casting an eye to the future, UK-based research group Cornwall Insight said last year that the NEM will likely add 150GW of solar PV, wind and energy storage capacity by 2043. A report outlines that the installed capacity for these technologies is expected to rise from 52GW in 2025 to 208GW by 2043, representing a 300% increase.

NEM deemed ‘outdated and stalling investment’

Despite the growing solar PV in Australia, advocacy and engagement platform Clean Energy Investor Group (CEIG) has said that the outdated NEM design is stifling investment in large-scale renewable energy projects.

Indeed, CEIG stated that the NEM’s outdated design, built around an era of coal and gas power, jeopardises investment in technologies such as solar PV, wind, and battery energy storage systems (BESS).

Richie Merzian, CEO of the Clean Energy Investor Group, said the ongoing retraction of US policy away from renewables is an opportunity for Australia to attract investment into its energy transition.

“Australia has an incredible opportunity to attract investment to our energy market if our market settings are right. “Investors need clear, effective and predictable signals to drive the investment needed to replace the ageing, unreliable coal fleet,” Merzian said.

Despite this, the Australian government launched a review of the NEM last year, aiming to identify how it will operate in the coming decades and facilitate the uptake of solar PV.

Merzian noted that this review will be a key step in ensuring the NEM is fit for purpose.

“The Federal government’s independent review of the NEM is a key step toward creating a grid that supports firmed renewable energy and the CEIG looks forward to working with the panel,” Merzian said.