Global electricity demand from data centres is set to “more than double” by 2030 to more than 945TWh annually, the report said. This will be driven by demand from “AI-optimised data centres”, which is set to more than quadruple in the same period. AI data centres increasingly use high-efficiency servers which lead to greater power density with higher demand. The IEA said that a “key input” for its predictions was the “near-term” projection for shipments of those servers to gauge the growth of data centre demand.

A “diverse range of energy sources” will meet that demand, though renewables and natural gas will likely lead it due to their cost-competitiveness and availability in “key markets”, the IEA said.

“AI is one of the biggest stories in the energy world today – but until now, policy makers and markets lacked the tools to fully understand the wide-ranging impacts,” said IEA executive director Fatih Birol.

US and China

“Global electricity demand from data centres is set to more than double over the next five years, consuming as much electricity by 2030 as the whole of Japan does today. The effects will be particularly strong in some countries,” Birol said.

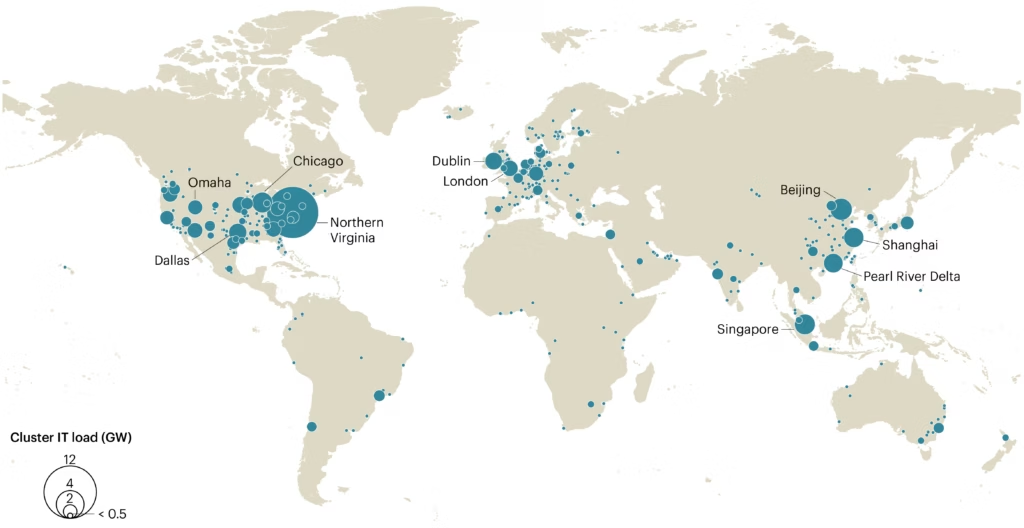

The US and China will account for almost 80% of global data centre demand growth through 2030, the report said, up by 130% and 170% respectively. The clustering of big tech and data cloud companies in the US and China has already seen a lot of deals between renewable energy developers and data centre operators. Meta – the company which owns Facebook, WhatsApp and Instagram – has signed hundreds of megawatts of solar PV PPAs in the US, and Amazon and Google have executed similar strategies to power growing data centre presences.

AI has also begun to emerge on the supply and infrastructure side, with increased usage for optimisation and grid services. A report from PV Tech Premium earlier this year said that Chinese state energy firms were “rushing” to integrate the DeepSeek AI platform into their operations and the US government has previously issued funding to seek AI-based solutions to the country’s grid interconnection challenges.

Europe and Japan will also see significant data centre demand growth, as well as emerging demand in Singapore and Malaysia.

Demand and efficiency

Data centre demand will put more strain on global grids, but the extent of that strain is uncertain. In its base rate scenario, the IEA forecasts AI data centres still accounting for just 3% of global consumption by 2030. That could alter by as much as 45% – up to around 4.4% of global electricity demand by 2035 – depending on financial and technological trends over the next decade.

However, the risks and demands created by AI generation can potentially be offset by harnessing AI’s capabilities.

Greater digitalisation and AI presence increases the risk of cybersecurity attacks on energy infrastructure, the IEA said. Simultaneously, AI is a “critical tool for energy companies to defend against such attacks”.

The same is true for emissions. Greater AI data centre demand will increase overall emissions, but the “increase will be small in the context of the overall energy sector and could potentially be offset by emissions reductions enabled by AI if adoption of the technology is widespread”, the report said. AI could also be used to speed up innovations in solar PV and energy storage technologies.

“With the rise of AI, the energy sector is at the forefront of one of the most important technological revolutions of our time,” Birol said. “AI is a tool, potentially an incredibly powerful one, but it is up to us – our societies, governments and companies – how we use it.”

The full Energy and AI report can be read here.