The SWIS is a grid providing power for around one million people in the state of Western Australia, alongside the North West Interconnected System (NWIS) in the Pilbara region, as part of the Wholesale Electricity Market (WEM).

Westerman noted that renewable power is meeting around 40% of Australia’s energy needs throughout the year, and accounting for as much as 72% of the demand on the east coast and 84% on the west coast.

Sustaining success in the NEM

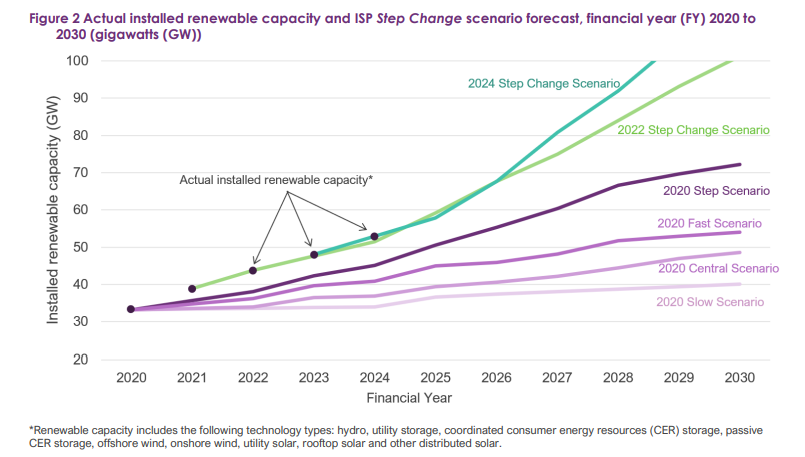

The report covering the NEM is broadly positive, noting that the region has more than 50GW of renewable power capacity in operation as of the end of the 2024 financial year. As shown in the graph below, this puts the market well on track to meet the renewable power installation targets set out in the AEMO’s latest Integrated System Plan (ISP), published this year that calls for installed renewable capacity to hit 100GW by 2028.

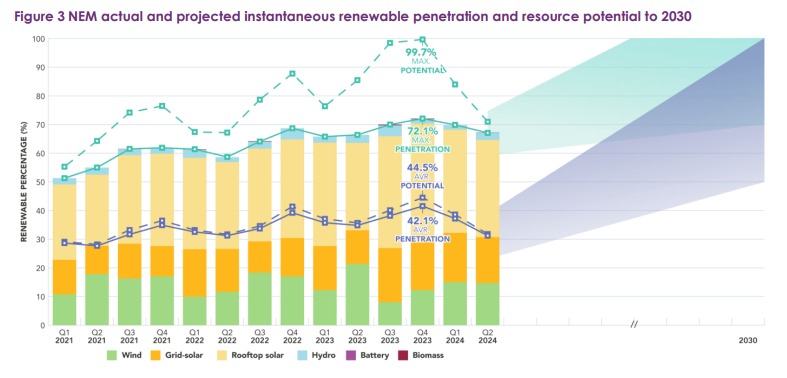

Renewable power penetration also reached 72.1% in the region in October 2023, and there is the potential for renewable energy to account for 99.7% of the market’s electricity demand. The report defines “renewable potential” as electricity generated within a 30-minute interval bid, meaning that, in October 2023, had all renewable energy sources in the market been dispatched within this timeframe, these sources would have met 99.7% of the region’s electricity demand.

Most notably there is considerable potential for the distributed solar sector in particular; on 31 December 2023, distributed PV generated enough electricity to meet 101.7% of South Australia’s electricity demand. While there is an issue of sample size here—this figure only refers to a single day in a single state—distributed solar has been driving the increasing penetration of renewable energy sources over the past four years in the NEM, as shown in the graph below.

Australia’s strong domestic solar market is nothing new—earlier this month, SunWiz noted that the world-leading sector saw 23% growth in July, setting a record for this part of the year—but the sheer volume of electricity generated by rooftop sources has sparked conversations about grid resilience in the NEM.

The report notes that, over the course of 2023, 68% large-scale solar and wind curtailment was triggered in response to unfavourable market conditions, suggesting that the region’s grid needs to be modernised, to not only provide power to consumers, but to do so in a financially viable manner.

The engineering report calls on grid operators to specify the performance requirements and procurement processes for grid-forming technologies, such as battery storage systems with advanced inverters, and building additional modelling capacity to help make more accurate predictions about future grid usage.

The report notes that AEMO has already started working with the Australian Bureau of Meteorology (BOM) to assess the quality of weather data collected from wind and solar farms, as part of a plan to improve the accuracy of data used in conducting weather modelling as part of renewable power generation forecasts.

These recommendations follow increasing calls for greater support for the distributed solar sector in particular, as rooftop solar looks set to be an integral part of Australia’s renewable transition. Last week, think tank Race for 2030 called on the federal government to provide additional investment and incentive opportunities to encourage the adoption of more rooftop solar, and earlier this month, Energy Networks Australia (ENA) urged the government to facilitate the installation of an additional 5GW of rooftop solar capacity.

Grid questions remain in the SWIS grid

The SWIS grid, too, is expecting considerable growth in its renewable sectors. While the NEM expects solar generation to account for as much of 90% of electricity demand in the long-term, AEMO forecasts that the SWIS grid will need to add around 50GW of new electricity generation—“predominantly large-scale wind and solar”—and storage infrastructure.

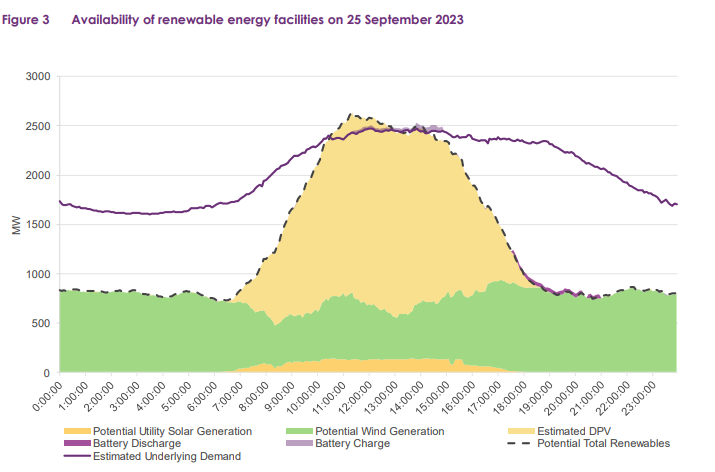

Similarly to the NEM, distributed solar is set to be a key component of this transition. During daylight hours, and in clear sky conditions, distributed PV leads electricity generation in Western Australia, with around 3GW of capacity installed in the market as of 2024.

The graph below demonstrates electricity demand, and availability of renewable energy facilities, on 25 September 2023, with distributed PV, in yellow, accounting for the majority of electricity generation around the middle of the day.

AEMO expects this trend to continue in the long-term, with installed distributed PV capacity set to more than double to 6.5GW by the end of 2034. However, adding this scale of generation capacity will require further grid investment.

AEMO estimates that, over the next 20 years, the SWIS grid will need an additional 4,000km of new high-capacity transmission lines, alongside retirements or upgrades of “aging transmission network assets”. This will be exacerbated by the retirement of coal-fired power plants across Australia, with the NEM expecting to remove coal generation from its energy mix by 2038, which will necessitate a tripling of new renewable energy capacity by 2050 to make up the shortfall in electricity generation.

“AEMO must be ready to operate the power system under all foreseeable conditions, including during periods of world-leading contribution from rooftop solar and grid-scale renewable energy,” said Westerman.

“We are working with leading international peers and local industry to remove the technical constraints to harnessing more renewable energy for the benefit of Australian homes and businesses.”