Australia’s inaugural Priority List identifies 56 priority projects nationally, including 24 transmission and 32 energy generation and storage projects.

Seven of these 32 energy generation and storage projects feature solar PV, amounting to 4,130MW of capacity. Many of these projects feature a co-located battery energy storage system (BESS) to optimise the power plant, a trend that has risen across the world in recent years.

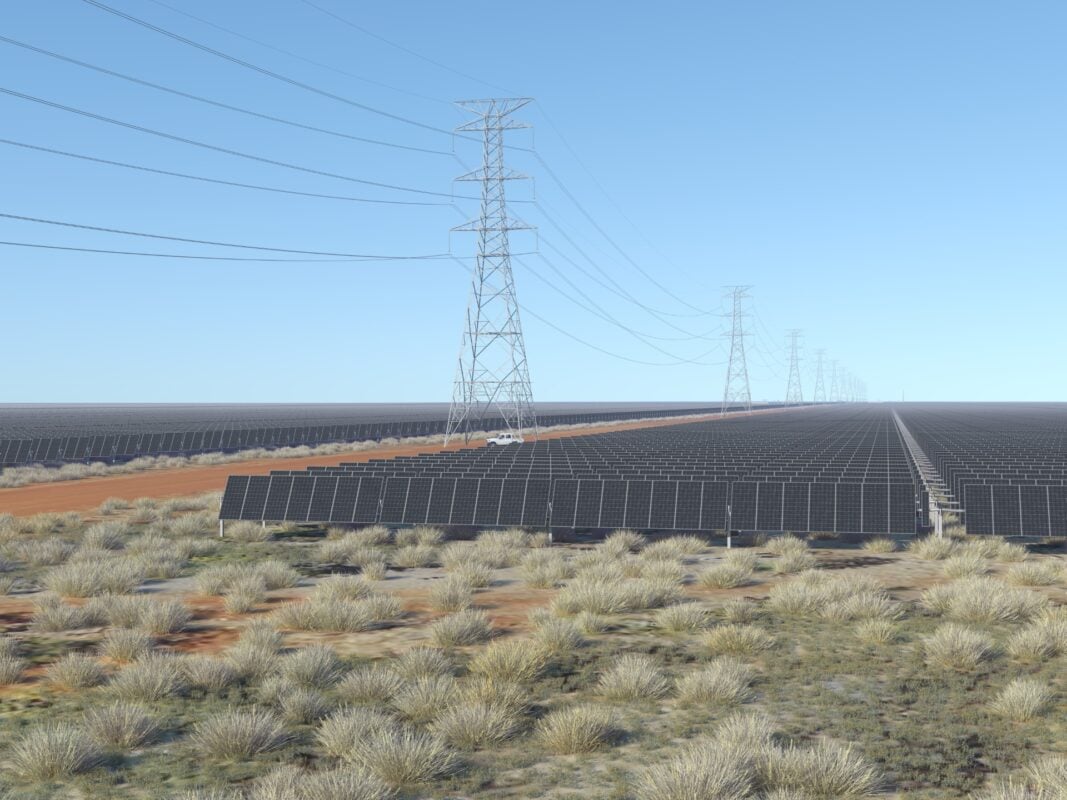

Noteworthy projects to have been added to the Priority List include the 1,000MW Australian Renewable Energy Hub (AREH), a wind and solar hybrid project being pursued by AREH in Western Australia, and the Darwin Battery Energy Storage System (DBESS), which will feed into SunCable’s Australia-Asia PowerLink (AAPowerLink) interconnector project.

The AAPowerLink project is set to deploy between 17GW and 20GW of solar capacity and between 36.42GWh and 42GWh of energy storage to connect Australia’s Northern Territory with Singapore via 4,300km of subsea cable and supply power to the territory’s capital, Darwin, and the surrounding region. You can find the energy generation and storage Priority List projects below.

| Project name | Company | State/Territory | Technology | Capacity (in MW) |

| Australian Renewable Energy Hub (AREH) | AREH Pty Ltd | Western Australia | Wind + Solar | 1,000 |

| Baru-Marnda | Yindjibarndi Energy Corporation | Western Australia | Wind + Solar | 550 |

| Barwon Solar Farm | Elgin Energy | Victoria | Solar + Battery | Solar: 250 BESS: 250 |

| Bashan Wind Farm | Bashan Wind Farm Pty Ltd | Tasmania | Wind | 460 |

| Bell Bay Wind | Equis | Tasmania | Wind + Battery | Wind: 224 BESS: 100 |

| Boomer Green Energy Hub | Ark Energy | Queensland | Wind | 1,000 |

| Bundey BESS and Solar Project | Genaspi Energy Group | South Australia | Solar + Battery | Solar: 900 BESS: 1,200 |

| Bungaban renewable energy project | Windlab Developments | Queensland | Wind + Battery | Wind: 1,400 BESS: 350 |

| Cannie Wind Farm | RES | Victoria | Wind | 1,300 |

| Capricornia Energy Hub – Pumped Hydroelectric Energy Storage | Copenhagen Infrastructure V SCSp (CI V) through Eungella PHES Pty Ltd ATF Eungella PHES Trust |

Queensland | Pumped hydro energy storage | 750 |

| Cellars Hill | Cellars Hill Wind Farm Pty Ltd | Tasmania | Wind | 350 |

| Cobbora Solar Farm | Pacific Partnerships Pty Ltd | New South Wales | Solar + Battery | Solar: 700 BESS: 400 |

| Darlington Wind Farm | Global Power Generation Australia Pty Ltd | Victoria | Wind | 324 |

| Darwin Battery Energy Storage System (DBESS) | SunCable | Northern Territory | Battery | 100 |

| Goyder North Stage Wind Farm | Neoen Australia | South Australia | Wind | 800 |

| Hallett BESS | EnergyAustralia | South Australia | Battery | 50 |

| Hexham Wind Farm | Wind Prospect Pty Ltd | Victoria | Wind | 686 |

| Liverpool Range Wind Farm | Tilt Renewables | New South Wales | Wind | 1,332 |

| Moreton Hill Wind Farm | Squadron Energy | Victoria | Wind | 420 |

| Mount Rawdon Pumped Hydro Project | Mt Rawdon Pumped Hydro Pty Limited | Queensland | Pumed hydro energy storage | 2,000 |

| Narrogin | Neoen Australia | Western Australia | Wind | 200 |

| Pacific Green Energy Park – Limestone Coast West | Pacific Green | South Australia | Battery | 250 |

| Parron Wind Farm | Zephyr Energy | Western Australia | Wind | 490 |

| Repowering of Woolnorth Wind Farm (Studland Bay and Bluff Point) | Woolnorth Renewables | Tasmania | Wind | 350 |

| Richmond Valley Solar and BESS | Ark Energy | New South Wales | Solar + Battery | Solar: 500 BESS: 275 |

| Solar River Solar and BESS Project | Solar River I Project Trust | South Australia | Solar + Battery | Solar: 230 BESS: 256 |

| Spicers Creek Wind Farm | Squadron Energy | New South Wales | Wind | 702 |

| St Patricks Plains Wind Farm | Ark Energy | Tasmania | Wind | 300 |

| Territory Battery | Neoen Australia | Australian Capital Territory | Battery | 150 |

| Theodore Wind Farm | Theodore Energy Development Pty Ltd | Queensland | Wind + Battery | Wind: 1,100 BESS: 240 |

| Valley of the Winds | Acen Australia | New South Wales | Wind | 900 |

| Waddi Wind Farm | Tilt Renewables | Western Australia | Wind | 108 |

Priority List to adopt ‘faster to yes, faster to no’ approach

According to the Australian government, projects in the Priority List adopt a ‘faster to yes, faster to no’ approach. Identified projects will receive additional support and facilitation through regulatory and environmental processes. However, they will still be subject to the same scrutiny as any other project and continue to be required to meet all statutory requirements.

The government intends to boost regulatory capacity to improve its services for priority projects. This enhancement will help project proponents speed up their assessment timelines.

The new suite of services includes increased engagement and guidance to help identify and address potential issues early on, reducing the risk of delays in project timelines.

Despite this, the government confirmed that statutory timeframes under the Environment Protection and Biodiversity Conservation (EPBC) Act apply to all projects, further reducing the risk of delays in the Commonwealth Environment Regulator’s consideration of projects.

Solar PV and wind generated over 4.5GWh in February 2025

As reported by PV Tech last week, analysis conducted by Rystad Energy found that all Australian solar PV and wind assets generated just over 4.5GWh of energy, up 14% year-on-year when it reached 3.9GWh.

New South Wales topped the list at the state level, generating 1,324GWh split between 813GWh from utility-scale solar PV and 511GWh from wind.

In the National Electricity Market (NEM), renewable energy generation, including hydro and biomass, reached 44% of the electricity mix in February—the highest recorded figure for the month. Meanwhile, in the Wholesale Electricity Market (WEM) covering Western Australia, renewable power accounted for 42% of the energy mix, up from the 37% figure recorded last year.

The 40MW Greenough River solar PV plant in Western Australia was deemed the best-performing utility-scale solar asset in the country in terms of AC capacity factor across the month. The project is owned by Bright Energy Investments – a joint venture between DIF Capital Partners, superannuation fund Cbus and state-owned Synergy.