Currently, the domestic content bonus offers a 10% bump on top of the IRA’s 30% investment and production tax credits (ITC/PTC) if projects meet the minimum 40% threshold for domestic components. This threshold—which will rise to 55% by 2027—is calculated based on the cost of products and components in a project.

The adder is optional, and projects without it can still be eligible for the ITC and PTC. But CEA said that this could change in the future, with the potential for domestic content to become “required to achieve the base 30% ITC”.

The 40-55% threshold is currently quite challenging for a utility-scale solar developer to reach, largely due to the makeup of the US solar manufacturing space. Ample developments in module assembly capacity across the country have yet to be followed by domestic cell or wafer manufacturing capacity, and cells and wafers account for a significant portion of the cost of a solar module. CEA’s report said that heavy reliance on PV cells could represent “up to 60% of project costs” for a large-scale solar installation.

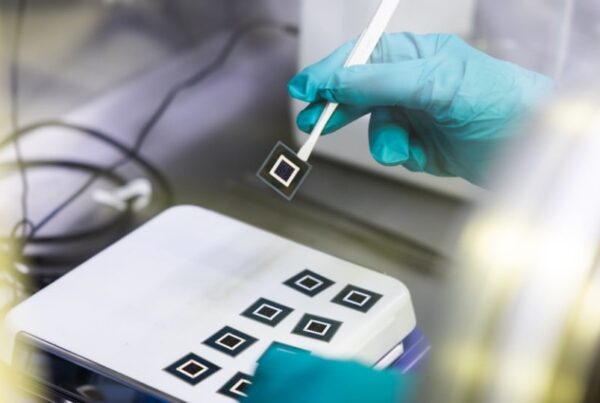

Solar cell capacity is beginning to come online in the US, but it still lags significantly behind module capacity.

If the domestic content threshold is rolled into the ITC, it could become much harder for many solar projects to qualify for the 30% base credit which has been a big part of the US’ impressive solar deployment expansion in recent years.

The report also said that the safe harbour method under the domestic content bonus could be eliminated.

Currently, projects can qualify for the bonus in two ways: the safe harbour and direct cost methods. The safe harbour method allows projects to use US government-specified percentages for individual components to reach the threshold, while the direct cost method requires calculating the direct costs for specific components, products and suppliers. CEA said the main challenge of the direct cost method is “the necessity for suppliers to disclose a detailed breakdown of their internal cost structure, specifically distinguishing between direct and indirect costs.”

Removing the simplified safe harbour method would increase the difficulty and administrative burden of reaching the domestic content threshold.

CEA said that a repeal of the entire IRA remains unlikely, regardless of these proposals.

Despite Donald Trump’s day-one executive order to put a pause on the disbursement of funds associated with the IRA, and members of the administration which have spoken of reversing some of the climate action initiated by the previous government, bipartisan groups of US lawmakers have repeatedly called for the IRA to remain intact.

CEA’s report said: “The clean energy industry has grown significantly, to a point that it has stakeholders across the political spectrum who value the jobs and economic development that it provides.”