“Concrete risks for companies”

“This is creating concrete risks for companies to go into insolvency as their significant stock will need to be devalued,” wrote SolarPower Europe CEO Walburga Hemetsberger in the group’s letter. “We have already witnessed the ingot producer Norwegian Crystals filing for bankruptcy on 21 August 2023.”

“The combined impacts of faster than expected power price decline, interest rate increases, and tightening bottlenecks around grid connections and project permitting all contributed to the slowing down of demand and were underestimated by wholesalers and developers ordering high quantities of PV equipment,” added Hemetsberger.

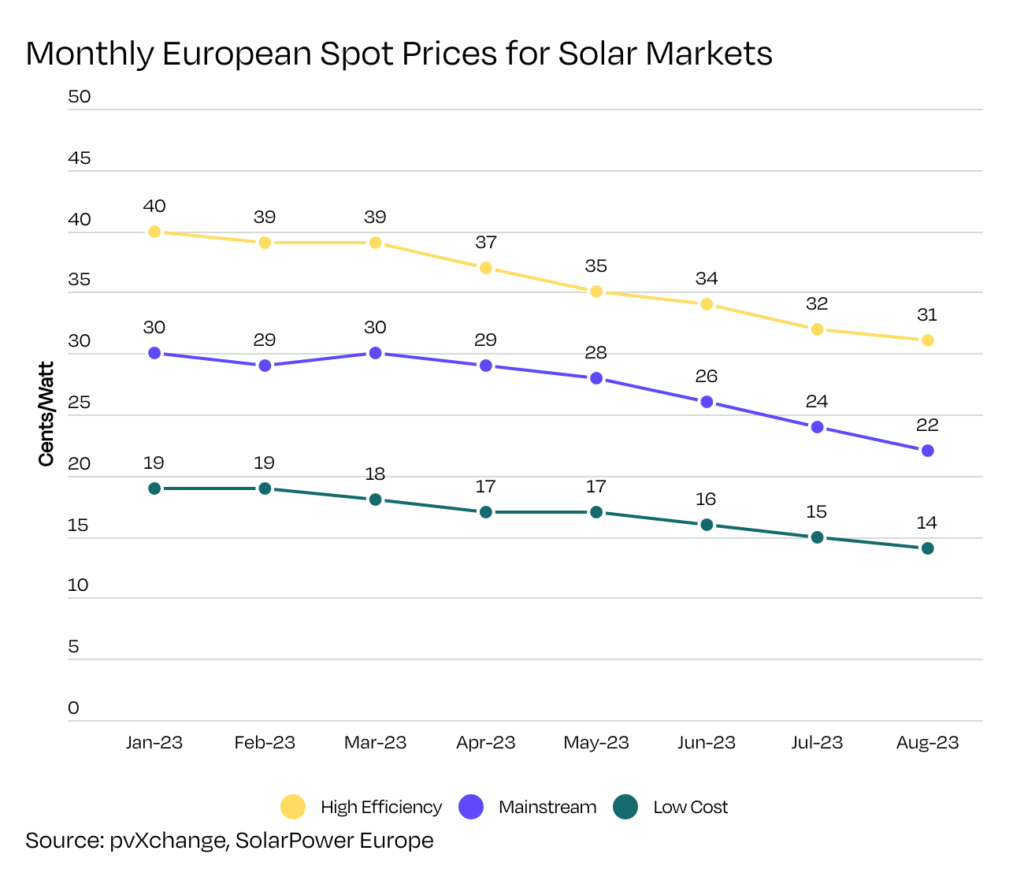

Prices have fallen across the sector, with the price of a high-efficiency solar module falling from EUR0.40 (US$0.43) to EUR 0.31 between January and August this year. The same trend is apparent in mainstream solar modules, which saw average prices fall from EUR0.3 to EUR0.22 over the same period, and in low-cost solar panels, where the price fell from EUR0.19 to EUR0.14 in the first six months of this year.

Falling prices are nothing new in the solar sector – a report from the Lawrence Berkeley National Laboratory found that the price of PV modules fell by 92% between 1998 and 2022 – but are now so low that SolarPower Europe is concerned that European companies will struggle to make a profit from the solar industry.

The body so pointed to a “perfect storm” of strong global demand, significant investment in new solar PV supply chains and a contraction of the European solar market in the second half of last year, which have led to overcapacities in the global supply chain, driving down the prices manufacturers can demand for their products.

Oversupply and underdemand

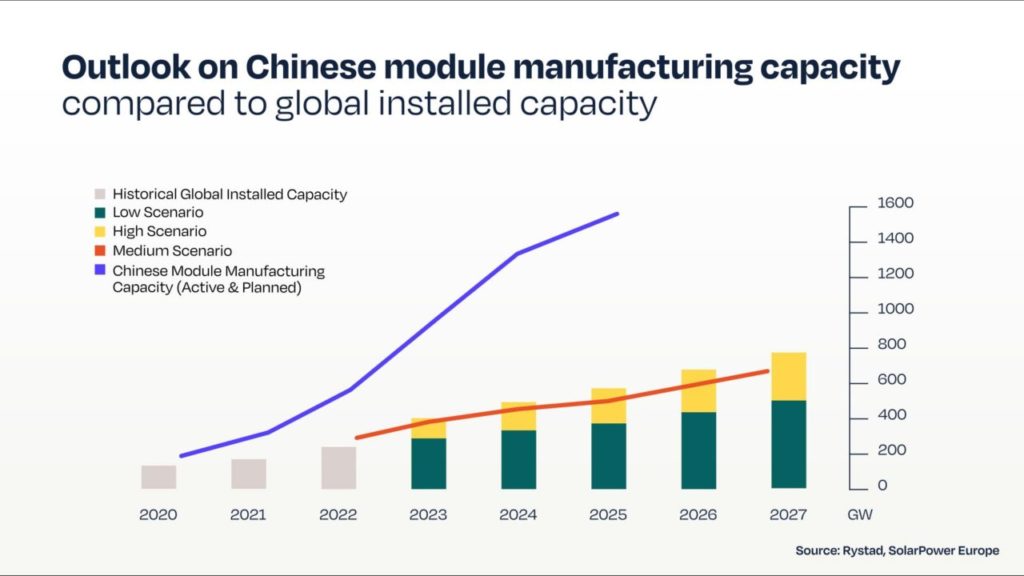

The oversupply of solar panels has already affected the European solar sector, with figures from Rystad suggesting that 40GW of Chinese PV modules are in storage in Europe, currently not being used.

The oversupply of Chinese modules in particular is significant, as many of the challenges pointed to by SolarPower Europe come in the wake of the passing of the Inflation Reduction Act (IRA). The US’ reluctance to import Chinese modules has forced Chinese companies to sell their products elsewhere, and with China showing little interest in cutting back on its massive solar manufacturing capacity, the price of European-made panels has fallen considerably.

“The combination of strong global demand signals during the pandemic (a demand-induced bullwhip effect) has led to new, large investment in solar PV supply chains with fierce competition between Chinese suppliers to gain market shares,” added Hemetsberger. “This has resulted in large overcapacities across the value chain – thus leading to quickly dropping prices for silicon to modules, inverters and batteries.”

This has occurred simultaneously with a lack of demand for European-made solar panels elsewhere in the world. In March, Reuters reported that US imports of Chinese panels had started to increase again, suggesting that the IRA has caused a temporary slowdown in the China-to-US supply chain, rather than forced the US to look elsewhere for new modules entirely.

Indeed, the US Solar Energy Industries Association estimates that, since the passing of the IRA, the US’ emphasis on developing domestic manufacturing facilities has added $US100 billion to the US economy, suggesting that the new legislation has not encouraged the US to look to Europe to meet its demand for solar panels, as some on the continent may have hoped, but turn inward, and look to secure domestic supply chains.

Reversing the decline

In response, SolarPower Europe has called on EU leadership to take seven steps to reverse the decline in solar prices, and provide a more stable foundation for the European solar sector.

Three of the group’s recommendations are more striking, starting with the acquisition of module inventories belonging to European PV manufacturers, to tackle the falling value of module manufacturers’ inventories. While such direct action would be unusual, it would not be unprecedented, with SolarPower Europe calling on the EU to use its special-purpose-vehicles, emergency policies implemented to achieve a particular goal quickly.

One example of this process is the EU’s maintenance of trade relations with Iran in 2018, after the US pulled out of its deal with the country, and began to reimpose economic sanctions on Iran, which threatened trade links between Iran and Europe.

Other recommendations include the establishment of a solar manufacturing bank to fund new solar manufacturing projects, and make such initiatives more financially viable, in the mould of the EU’s hydrogen bank, which was announced earlier this year. The body also calls on the EU to raise demand for solar PV in Europe by, for instance, mandating that new buildings on the continent be constructed with solar panels.

Many of these recommendations pertain to more effective enforcement of existing European legislation, including addressing “the inadequacies of the Temporary Transition and Crisis Framework” and accelerating adoption of the Net Zero Industry Act. The body also calls on supporting initiatives such as the Solar Stewardship Initiative, a programme to ensure good sustainability practices across the global supply chain, and encouraging collaboration between member states of SolarPower Europe.

“Inaction will jeopardise the implementation of the Green Deal Industry Plan,” wrote Hemetsberger at the end of the letter. “Right now, we risk losing a key strategic industry in Europe, precisely at the moment when energy transition geo-politics require supply chain diversification, and a revival of the European solar manufacturing sector.”