Cadmium telluride (CdTe) thin-film module manufacturer Toledo Solar has recently announced an expansion of its manufacturing capacity in the US in response to the passage of the Inflation Reduction Act (IRA) and its expansion across Europe and Central Asia by partnering with Turkish-based material manufacturer KordSA.

While increasing its production capacity to 2.8GW by 2027 – the company currently produces 100MW annually – was always in the Ohio-based company’s roadmap, the IRA accelerated that process twofold, according to Aaron Bates, CEO of Toledo Solar.

“The difference was that we believed through just organic growth and through the access to capital, such as a company like ours had at the time, that was more of a 10-year plan,” he told PV Tech Premium.

Bates said that the company’s European expansion was not based on any expectation of policy support from the EU, although he would welcome a similar policy to the US’ IRA or India’s Production Linked Incentive (PLI).

“Our ethos as an investment group that started Toledo Solar is not to make any investments based on policy. And the reason for that is that policy can change very quickly.”

Even though that is the case, Bates praised India’s PLI scheme to incentivise domestic manufacturing as well as its import tariffs – the 40% Basic Customs Duty (BCD) on solar modules has been in place since April 2022 – on Chinese solar equipment.

“They are well ahead of the game. What other countries need to look at those types of trade policies and solar I always point to India. They’re really far ahead of things.”

The company will manufacture its thin film solar modules in Europe, which Bates said would allow Toledo Solar and KordSA to play on a levelling field with Chinese silicon manufacturers without the need of subsidy as well as being able to regionally source its supply chain of raw materials.

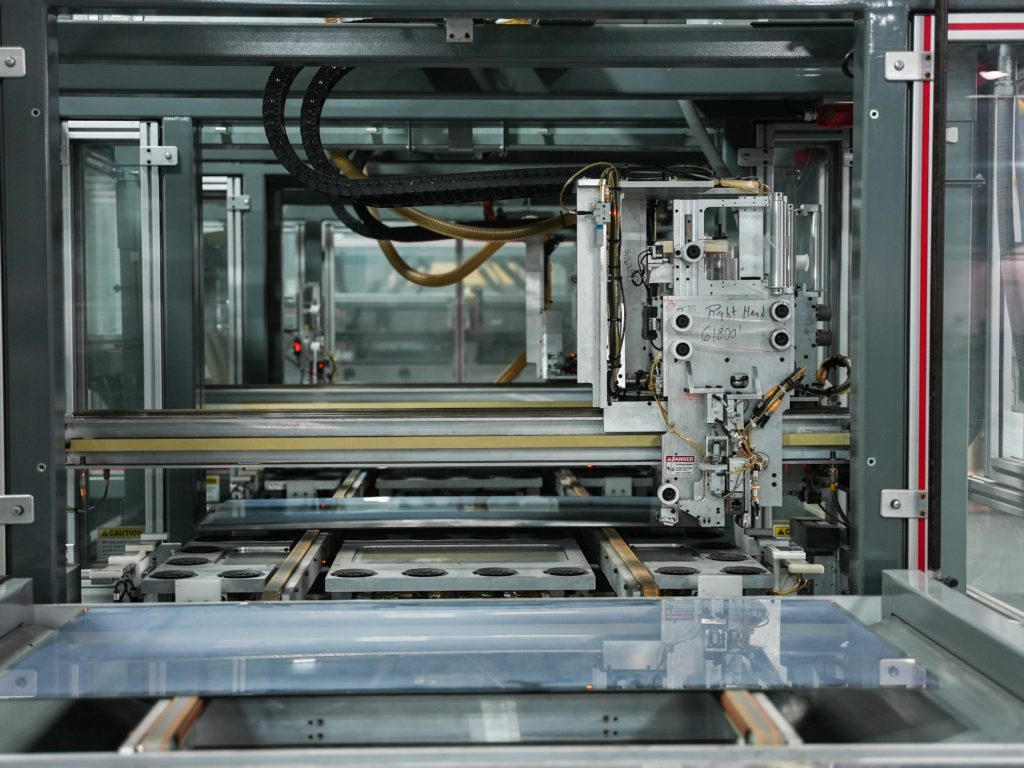

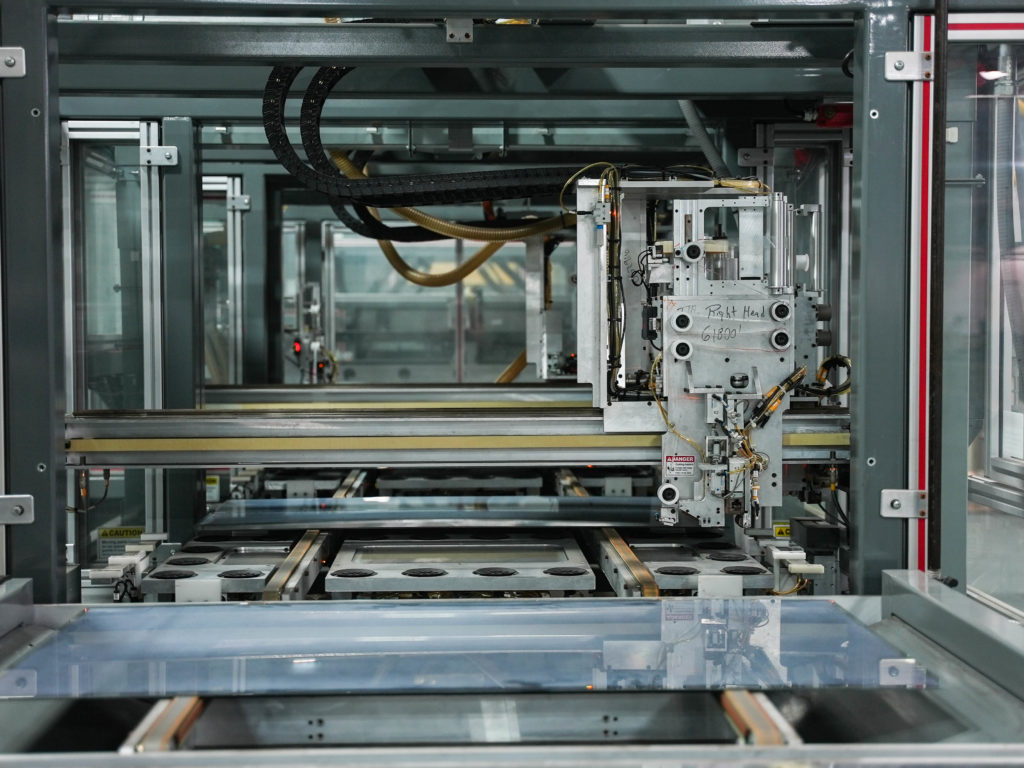

Moreover, the company uses vapor transport deposition to make the semiconductors on the glass for its modules and allows for a “high rate of manufacturing and a very high quality of manufacturing”, said Bates, adding that CdTe does not require as much energy as silicon. Soaring power prices are an issue for the manufacturing industry in Europe, with 35GW of capacity at risk from high energy prices.

The reason why Toledo Solar decided to partner with KordSA and its parent company, Sabanci, was because of the different manufacturing facilities they have in Turkey and around the world as well as its R&D facilities.

“They have some R&D centres in Turkey that are just top notch, they are top in the world,” said Bates, adding the automation of some facilities that uses polymers is not dissimilar to what is needed for solar modules.

But the discussion between both companies, which started more than a year ago, was triggered by the ongoing need for energy independence. Both from fossil fuels and China’s dominance in the supply chain of solar PV, which has become a global issue, Bates noted.

Even though planning for the next step of that collaboration with KordSA is still in early days, Bates says the companies are currently looking at four potential sites to build outside the US, even though numbers could vary as plans progress.

As for the initial capacity the plants could have, they’ll be bigger than the one currently in Ohio, and would start at 400MW, according to Toledo Solar’s analysis.

“That’s kind of the minimum amount of capital expenditure that you would want to see on your rate of return,” said Bates.

There would be the possibility of expanding in the future to 3.3GW of capacity.

Furthermore, the partnership will at first focus on the non-utility scale market, given that is the company’s expertise in the US, said Bates. “You want to make sure that the business case matches the markets that you’re going towards.”

That said, Toledo Solar might explore the idea of doing some smaller utility-scale projects that are less than 10MW, for instance, but it will not have one solar buyer due to the higher risk, Bates added.

Both Toledo Solar and KordSA are still at the stage of locating where to build the first plant in Europe, or if it could be multiple plants at the same time. From ground breaking to until the plant is fully functioning could be achieved in eight to 12 months, according to Bates.